The following information relates to Questions 1-6

Cécile Perreaux is a junior analyst for an international wealth management firm. her supervi-sor, Margit daasvand, asks Perreaux to evaluate three fixed-income funds as part of the firm's global fixed-income offerings. Selected financial data for the funds aschel, Permot, and rosaiso are presented in exhibit 1. in Perreaux's initial review, she assumes that there is no reinvestment income and that the yield curve remains unchanged.

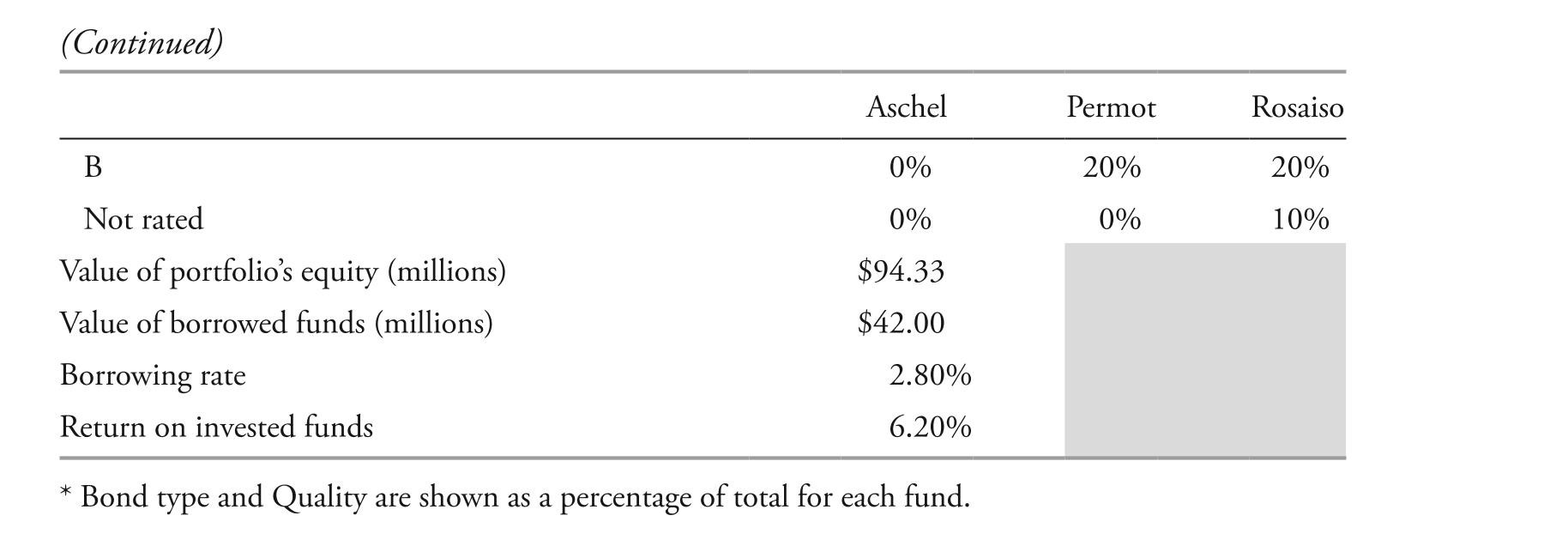

EXHIBIT 1 Selected Data on Fixed-Income Funds

after further review of the composition of each of the funds, Perreaux notes the following.

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

-The levered portfolio return for aschel is closest to:

Definitions:

Securities and Exchange Commission

A U.S. federal agency responsible for enforcing federal securities laws and regulating the securities industry, stock and options exchanges.

Securities and Exchange Act

A U.S. law enacted in 1934 to regulate securities transactions on the secondary market, thereby protecting investors and maintaining fair and efficient functioning of the securities markets.

New York Stock Exchange

A leading global securities exchange where stocks, bonds, and other financial instruments are traded, located in New York City.

FDIC

The Federal Deposit Insurance Corporation, a United States government agency that insures deposits at banks and savings associations.

Q1: Find the radian measure of the

Q2: Solve the exponential equation algebraically. Approximate

Q4: if uNab experienced a credit event on

Q9: polyethylene bar ( <span class="ql-formula"

Q15: The holding period for a bond at

Q19: Find the exact values of the

Q19: The answer to Prégent's question is that

Q25: based on exhibit 1 and abram's expectation

Q30: Find the standard form of the

Q32: Find the exact value of the