The following information relates to Questions 1-6

Cécile Perreaux is a junior analyst for an international wealth management firm. her supervi-sor, Margit daasvand, asks Perreaux to evaluate three fixed-income funds as part of the firm's global fixed-income offerings. Selected financial data for the funds aschel, Permot, and rosaiso are presented in exhibit 1. in Perreaux's initial review, she assumes that there is no reinvestment income and that the yield curve remains unchanged.

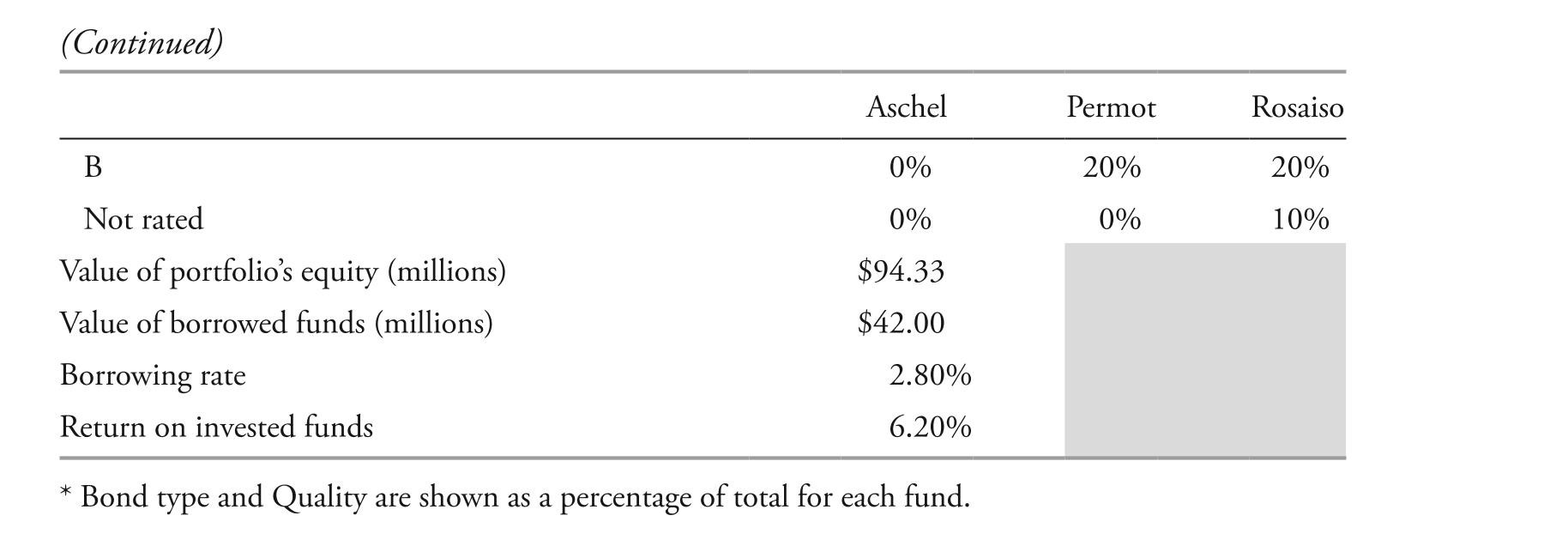

EXHIBIT 1 Selected Data on Fixed-Income Funds

after further review of the composition of each of the funds, Perreaux notes the following.

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

-based on exhibit 1, the rolling yield of aschel over a one-year investment horizon is closest to:

Definitions:

Cash Receipts

The monetary amounts received by a company during a specific period for goods sold, services provided, or any other business activities.

Bank Loan

A sum of money borrowed from a bank that must be repaid with interest over a predetermined period.

Net Income

The total profit of a company after all expenses and taxes have been subtracted from revenue.

Revenues

The income generated from normal business operations, calculated by multiplying the price of goods or services by the quantity sold.

Q5: based on exhibit 1, the upfront premium

Q5: Which of the following characteristics of a

Q7: an investor in a country with an

Q10: Based on Exhibit 1, which key rate

Q12: In a securitization, the collateral is initially

Q22: Use the graph of the function

Q34: The risk that the price at which

Q46: Use the sum-to-product formulas to select

Q63: Find the standard form of the

Q170: The relationship between the Fahrenheit and