The following information relates to Questions 1-6

Cécile Perreaux is a junior analyst for an international wealth management firm. her supervi-sor, Margit daasvand, asks Perreaux to evaluate three fixed-income funds as part of the firm's global fixed-income offerings. Selected financial data for the funds aschel, Permot, and rosaiso are presented in exhibit 1. in Perreaux's initial review, she assumes that there is no reinvestment income and that the yield curve remains unchanged.

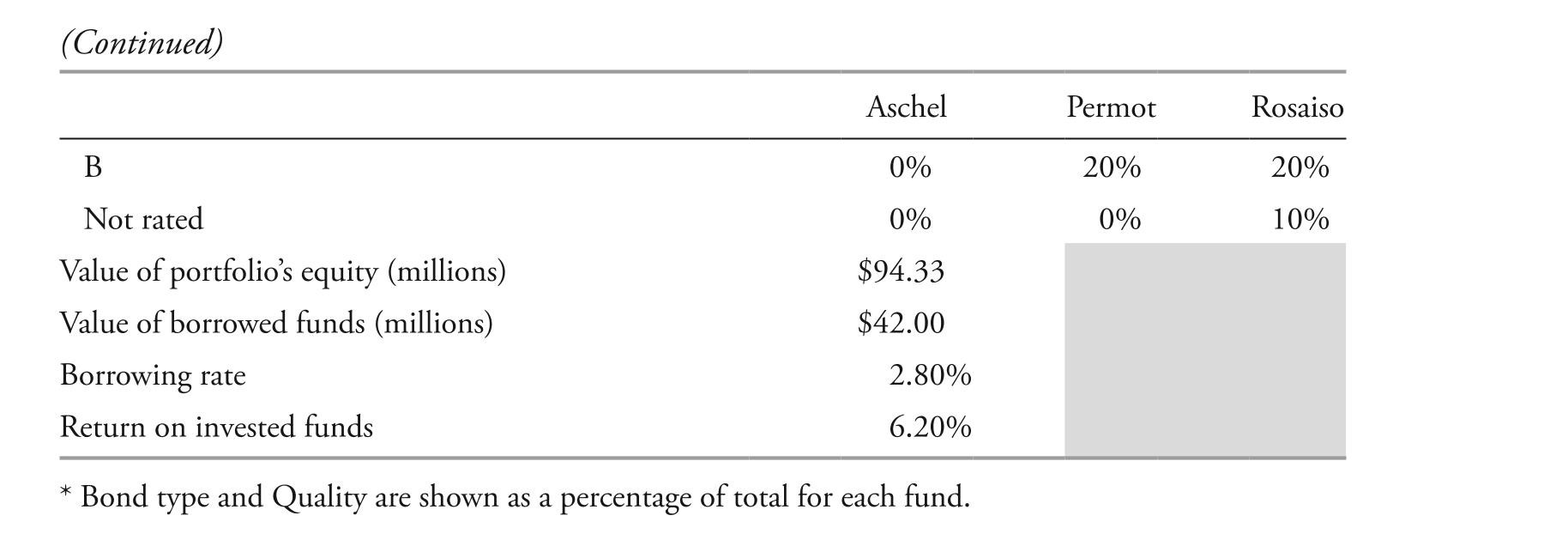

EXHIBIT 1 Selected Data on Fixed-Income Funds

after further review of the composition of each of the funds, Perreaux notes the following.

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

-based on note 2, rosaiso is the only fund for which the expected change in price based on the investor's views of yields and yield spreads should be calculated using:

Definitions:

Recurring Themes

Motifs or concepts that appear repeatedly in a piece of literature, film, artwork, or other forms of cultural expression, often underscoring a particular idea or message.

Sexual Content

Material, such as images, writing, or behavior, that is explicitly or implicitly related to sexual themes or activities.

Experiences

Events or occurrences that leave an impression on an individual, contributing to their knowledge, perceptions, and personal growth.

Hypnagogic Imagery

Vivid visual phenomena that occur in the transition from wakefulness to sleep, often accompanied by sensory experiences.

Q8: centroid of the L-shaped segment shown

Q14: Suppose that the graph of is

Q17: Given the description of the asset pool

Q26: Compared with developed markets bonds, emerging markets

Q28: based on exhibit 1, which short position

Q38: The most appropriate response to Madison's question

Q45: Evaluate the logarithm using the change-of-base

Q53: The table shows the average daily

Q75: Select the curve represented by the

Q79: Find the range of the function.<br>