The following information relates to Questions

anna lebedeva is a fixed-income portfolio manager. Paulina Kowalski, a junior analyst, and lebedeva meet to review several positions in lebedeva's portfolio.

lebedeva begins the meeting by discussing credit rating migration. Kowalski asks leb-edeva about the typical impact of credit rating migration on the expected return on a bond.

lebedeva asks Kowalski to estimate the expected return over the next year on a bond issued byentre corp. The bbb rated bond has a yield to maturity of 5.50% and a modified duration of 7.54. Kowalski calculates the expected return on the bond over the next year given the partial

credit transition and credit spread data in exhibit 1. She assumes that market spreads and yields will remain stable over the year. lebedeva next asks Kowalski to analyze a three-year bond, issued by Vrairive S.a., using an arbitrage-free framework. The bond's coupon rate is 5%, with interest paid annually and a par value of 100. in her analysis, she makes the following three assumptions:

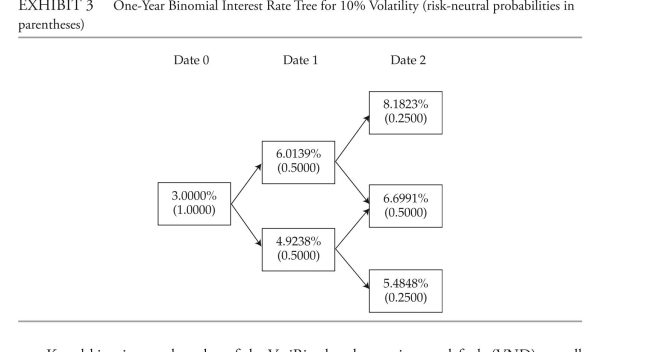

• The annual interest rate volatility is 10%.

• The recovery rate is one-third of the exposure each period.

• The hazard rate, or conditional probability of default each year, is 2.00%.

Selected information on benchmark government bonds for the Vrairive bond is presented

in exhibit 2, and the relevant binomial interest rate tree is presented in exhibit 3.  Kowalski estimates the value of the Vrairive bond assuming no default (Vnd) as wellas the fair value of the bond. She then estimates the bond's yield to maturity and the bond'scredit spread over the benchmark in exhibit 2. Kowalski asks lebedeva, "What might cause the bond's credit spread to decrease?"

Kowalski estimates the value of the Vrairive bond assuming no default (Vnd) as wellas the fair value of the bond. She then estimates the bond's yield to maturity and the bond'scredit spread over the benchmark in exhibit 2. Kowalski asks lebedeva, "What might cause the bond's credit spread to decrease?"

lebedeva and Kowalski next discuss the drivers of the term structure of credit spreads.Kowalski tells lebedeva:Statement 1: The credit term structure for the most highly rated securities tends to be either flat or slightly upward sloping.Statement 2: The credit term structure for lower-rated securities is often steeper, and creditspreads widen with expectations of strong economic growth.next, Kowalski analyzes the outstanding bonds of dll corporation, a high-quality issuerwith a strong, competitive position. her focus is to determine the rationale for a positively sloped credit spread term structure.lebedeva ends the meeting by asking Kowalski to recommend a credit analysis approach

for a securitized asset-backed security (abS) held in the portfolio. This non-static asset pool is made up of many medium-term auto loans that are homogeneous, and each loan is small relative to the total value of the pool.

-The most appropriate response to Kowalski's question regarding credit rating migration is that it has:

Definitions:

Career Development

The progression through a series of employment stages, characterized by changes in job responsibilities, skills and roles.

Salary

A fixed regular payment, typically provided on a monthly or biweekly basis, earned by an employee from an employer.

Workload

The amount of work assigned to or expected from a person within a given time period.

Hardy Personality

A trait of individuals who remain resilient and stress-tolerant by viewing challenges as opportunities rather than threats, helping them cope with stress more effectively.

Q2: Which of the following bond types provides

Q4: With respect to their discussion of yield

Q4: which bond in Exhibit 1 most likely

Q5: a 10-year bond was issued four years

Q8: A steel bolt <span

Q11: did Tyo's assistant accurately describe the process

Q13: Which of the following statements about duration

Q21: A fixed income analyst is least likely

Q24: Select the graph for following equation.

Q165: If a rock is thrown upward