The following information relates to Questions

daniela ibarra is a senior analyst in the fixed-income department of a large wealth manage-ment firm. Marten Koning is a junior analyst in the same department, and david lok is a member of the credit research team.

The firm invests in a variety of bonds. ibarra is presently analyzing a set of bonds with some similar characteristics, such as four years until maturity and a par value of €1,000. exhibit 1 includes details of these bonds.

exhibit 1 a brief description of the bonds being analyzed bond descriptionb1 a zero-coupon, four-year corporate bond with a par value of €1,000. The wealth management firm's research team has estimated that the risk-neutral probability of default (the hazard rate) for each date for the bond is 1.50%, and the recovery rate is 30%.b2 a bond similar to b1, except that it has a fixed annual coupon rate of 6% paid annually.

b3 a bond similar to b2 but rated aa.

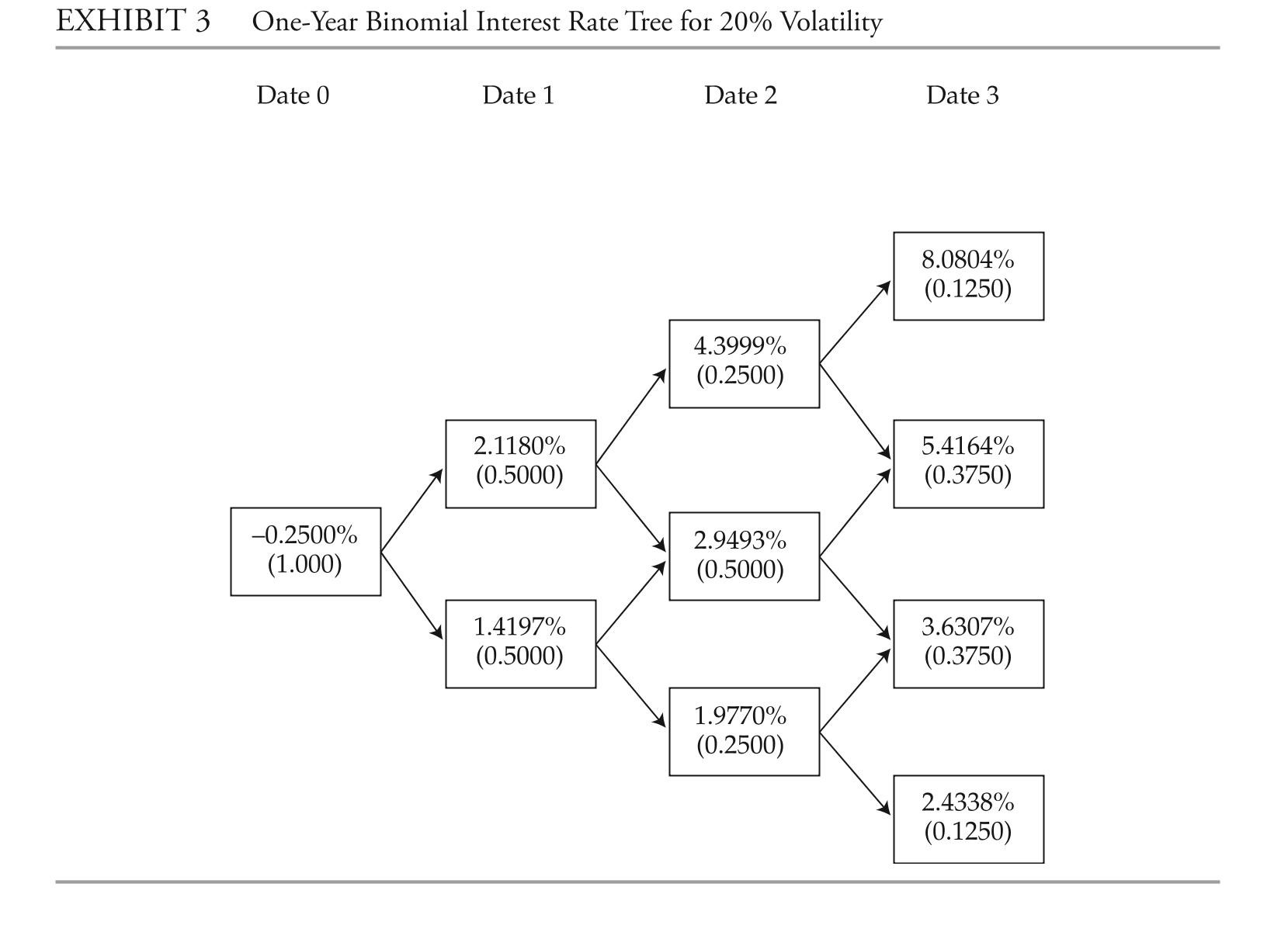

b4 a bond similar to b2 but the coupon rate is the one-year benchmark rate plus 4%.ibarra asks Koning to assist her with analyzing the bonds. She wants him to perform the analysis with the assumptions that there is no interest rate volatility and that the government bond yield curve is flat at 3%.ibarra performs the analysis assuming an upward-sloping yield curve and volatile interest rates. exhibit 2 provides the data on annual payment benchmark government bonds.1 She uses these data to construct a binomial interest rate tree (shown in exhibit 3) based on an assump-tion of future interest rate volatility of 20%.

1 For simplicity, this exhibit uses

answer the first five questions (1-4) based on the assumptions made by Marten Koning,the junior analyst. answer questions (8-12) based on the assumptions made by daniela ibarra, the senior analyst.

answer the first five questions (1-4) based on the assumptions made by Marten Koning,the junior analyst. answer questions (8-12) based on the assumptions made by daniela ibarra, the senior analyst.

Note: all calculations in this problem set are carried out on spreadsheets to preserve reci-sion. The rounded results are reported in the solutions.

-The issuer of the floating-rate note b4 is in the energy industry. ibarra personally believes that oil prices are likely to increase significantly within the next year, which will lead to an

Improvement in the firm's financial health and a decline in the probability of default from 1.50% in year 1 to 0.50% in years 2, 3, and 4. based on these expectations, which of the

Following statements is correct?

Definitions:

Psychosocially

Pertaining to the interrelation of social factors and individual thought and behavior, often considered in understanding psychological well-being or disorders.

Medical Diagnoses

The process of determining which disease or condition explains a person's symptoms and signs based on a clinical assessment.

Prenatal Care

Medical and nursing care recommended for women during pregnancy, aimed at monitoring and promoting the health of both the mother and the fetus.

Urinary Infection

An infection of the urinary system, including the bladder, kidneys, ureters, and urethra, often caused by bacteria.

Q3: Credit yield spreads most likely widen in

Q6: based on exhibit 1, which bond most

Q7: based on exhibits 3 and 4, the

Q13: Evaluate the limit. <span class="ql-formula"

Q21: A fixed income analyst is least likely

Q25: When issuing debt, a company may use

Q31: based on only the leverage ratios in

Q35: <span class="ql-formula" data-value="\text { Let } f

Q42: in order to determine the capacity of

Q56: The current I (in amperes) when