The following information relates to Questions 11-19

Rayes investment Advisers specializes in fixed-income portfolio management. Meg Rayes, the owner of the firm, would like to add bonds with embedded options to the firm's bond port-folio. Rayes has asked Mingfang Hsu, one of the firm's analysts, to assist her in selecting and analyzing bonds for possible inclusion in the firm's bond portfolio.Hsu first selects two corporate bonds that are callable at par and have the same character-istics in terms of maturity, credit quality and call dates. Hsu uses the option-adjusted spread(oAS) approach to analyse the bonds, assuming an interest rate volatility of 10%. The resultsof his analysis are presented in Exhibit 1.

EXHIBIT 1 Summary Results of Hsu's Analysis Using the OAS Approach

Hsu then selects the four bonds issued by Rw, inc. given in Exhibit 2. These bonds all have a maturity of three years and the same credit rating. Bonds 4 and 5 are identical to Bond3, an option-free bond, except that they each include an embedded option.

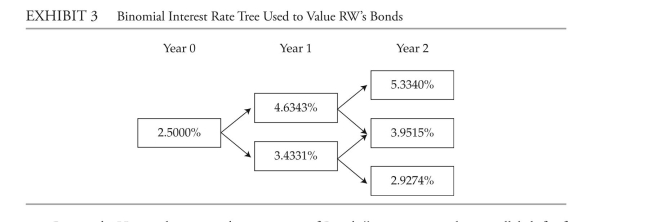

To value and analyze Rw's bonds, Hsu uses an estimated interest rate volatility of 15% and constructs the binomial interest rate tree provided in Exhibit 3.

Rayes asks Hsu to determine the sensitivity of Bond 4's price to a 20 bps parallel shift ofthe benchmark yield curve. The results of Hsu's calculations are shown in Exhibit 4.EXHiBiT 4 Summary Results of Hsu's Analysis about the Sensitivity of Bond 4's Price to a ParallelShift of the Benchmark yield Curve Magnitude of the Parallel Shift in the Benchmark yield Curve +20 bps −20 bps full Price of Bond 4 (% of par) 100.478 101.238 Hsu also selects the two floating-rate bonds issued by Varlep, plc given in Exhibit 5. These

bonds have a maturity of three years and the same credit rating.

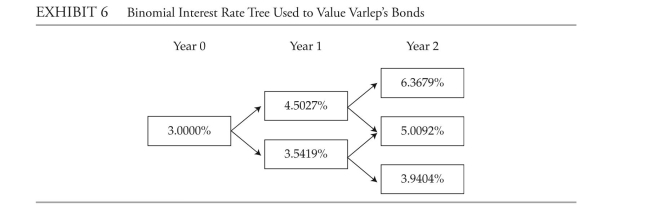

To value Varlep's bonds, Hsu constructs the binomial interest rate tree provided inExhibit 6.

last, Hsu selects the two bonds issued by whorton, inc. given in Exhibit 7. These bonds are close to their maturity date and are identical, except that Bond 9 includes a conversion option. whorton's common stock is currently trading at $30 per share.

-The factor that is currently least likely to affect the risk-return characteristics of Bond 9 is:

Definitions:

Good-For-Nothing

A derogatory term used to describe someone or something that is of no use or value.

Rhesus Monkeys

A species of Old World monkeys widely used in medical and biological research, known for their robust adaptability and sociable nature.

Wire-Mesh

A type of fencing made from interwoven wires forming a grid-like pattern, used for various applications such as barriers, screens, or enclosures.

Terry-Cloth

is a fabric with loops that can absorb large amounts of water, commonly used for towels and bathrobes.

Q8: relative to the canadian government bond index,

Q12: A cylindrical tank is assembled by

Q24: Select the graph for following equation.

Q29: Based on the information in Exhibit 1

Q41: Evaluate the following expression. <span

Q52: Convert the polar equation to rectangular

Q57: Suppose that <span class="ql-formula" data-value="f"><span

Q91: Select the graph of the polar

Q99: <span class="ql-formula" data-value="\text { If } f

Q132: Evaluate the limit.<br> <span class="ql-formula" data-value="\lim