The following information relates to Questions 28-36Jules Bianchi is a bond analyst for Maneval investments, inc. Bianchi gathers data on three

corporate bonds, as shown in Exhibit 1.EXHiBiT 1 Selected Bond dataissuer Coupon Rate Price Bond description Ayrault, inc. (Ai) 5.25% 100.200 Callable at par in one year and twoyears from today Blum, inc. (Bi) 5.25% 101.300 option-free Cresson Enterprises (CE) 5.25% 102.100 Putable at par in one year from todayNote: Each bond has a remaining maturity of three years, annual coupon payments, and a credit rating of BBB.

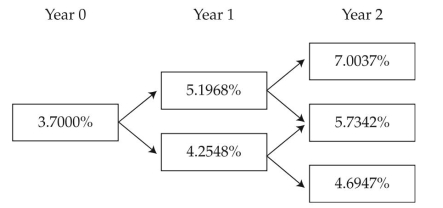

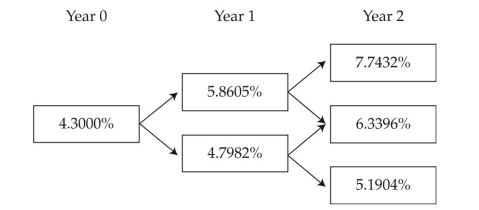

To assess the interest rate risk of the three bonds, Bianchi constructs two binomial interest rate trees based on a 10% interest rate volatility assumption and a current one-year rate of 1%.Panel A of Exhibit 2 provides an interest rate tree assuming the benchmark yield curve shifts down by 30 bps, and Panel B provides an interest rate tree assuming the benchmark yield curve

shifts up by 30 bps. Bianchi determines that the Ai bond is currently trading at an option-ad-justed spread (oAS) of 13.95 bps relative to the enchmark yield curve.EXHiBiT 2 Binomial interest Rate Trees

Armand Gillette, a convertible bond analyst, stops by Bianchi's office to discuss two con-vertible bonds. one is issued by delille Enterprises (dE) and the other is issued by Raffarin incorporated (Ri) . Selected data for the two bonds are presented in Exhibits 3 and 4.

EXHIBIT 3 Selected Data for DE Convertible Bond

EXHIBIT 4 Selected Data for RI Convertible Bond

Gillette makes the following comments to Bianchi:

• "The dE bond does not contain any call or put options but the Ri bond contains both an embedded call option and a put option. i expect that delille Enterprises will soon announce a common stock dividend of €0.70 per share."

• "My belief is that, over the next year, Raffarin's share price will appreciate toward the con-version price but not exceed it."

-Based on Exhibits 1 and 2, the effective duration for the Ai bond is closest to:

Definitions:

Q2: the force in truss member BG is:<br><img

Q3: hollow circular post ABC (see figure)

Q8: An aluminum light pole weighs 4300

Q13: The effects of a non-parallel shift in

Q17: Determine which portfolio in exhibit 2

Q24: Credit spreads are most likely to widen:<br>A)

Q24: Select the graph for following equation.

Q34: Find the inclination <span class="ql-formula"

Q83: Select the graph of the polar

Q84: Select the curve represented by the