The following information relates to Questions 1-10

Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies. on 1 october 20X0, Steele ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating.

EXHiBiT 1 fixed-Rate Bonds issued by Pro Star, inc.

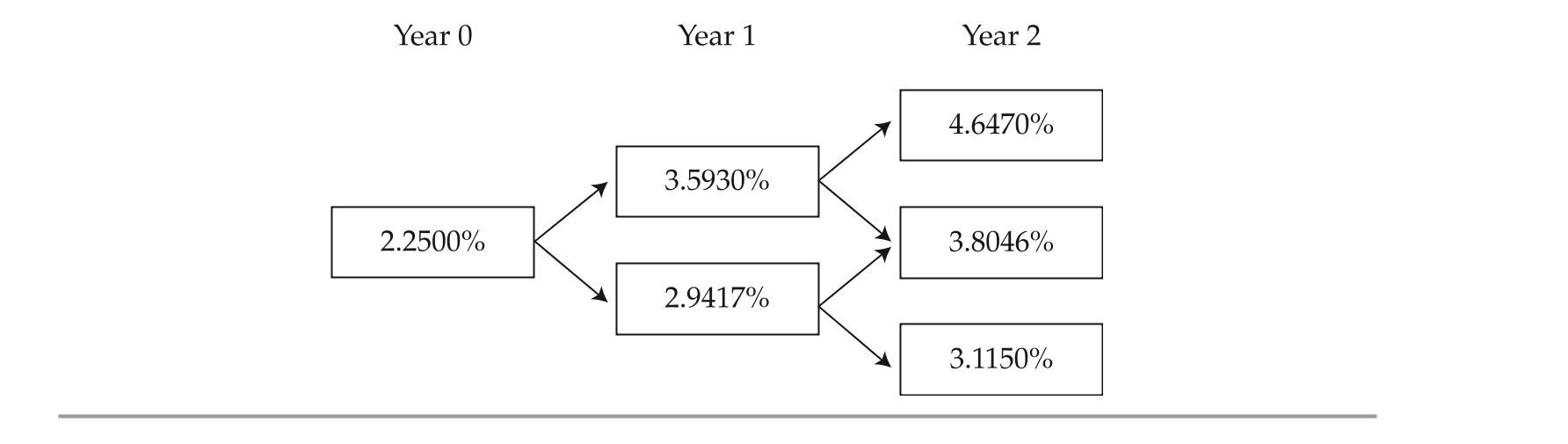

The one-year, two-year, and three-year par rates are 2.250%, 2.750%, and 3.100%, re-spectively. Based on an estimated interest rate volatility of 10%, ferguson constructs the bino-mial interest rate tree shown in Exhibit 2.

EXHiBiT 2 Binomial interest Rate Tree

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

EXHiBiT 3 Convertible Bond issued by Pro Star, inc.

-The call feature of Bond 2 is best described as:

Definitions:

Demands

Refers to the requirements or needs that must be met in various contexts, such as job demands in the workplace.

Environment

Environment refers to the surroundings or conditions in which a person, plant, or animal lives or operates, encompassing both natural and built settings.

MMPI-2

The Minnesota Multiphasic Personality Inventory-2, a widely used psychological assessment tool designed to evaluate a variety of psychological conditions and personality attributes.

Scales Included

Indicates that specific scales or measurements are part of a study, test, or assessment tool.

Q2: cable and frictionless pulley system at

Q3: Credit yield spreads most likely widen in

Q6: The most appropriate response to Kowalski's question

Q10: the perpendicular distance d (in.)

Q10: If a rock is thrown upward

Q14: A steel hanger with solid cross section

Q39: Is Madison's response regarding the factors that

Q56: The current I (in amperes) when

Q88: The position of a car is

Q97: Determine whether <span class="ql-formula" data-value="f"><span