The following information relates to Questions 1-10

Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies. on 1 october 20X0, Steele ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating.

EXHiBiT 1 fixed-Rate Bonds issued by Pro Star, inc.

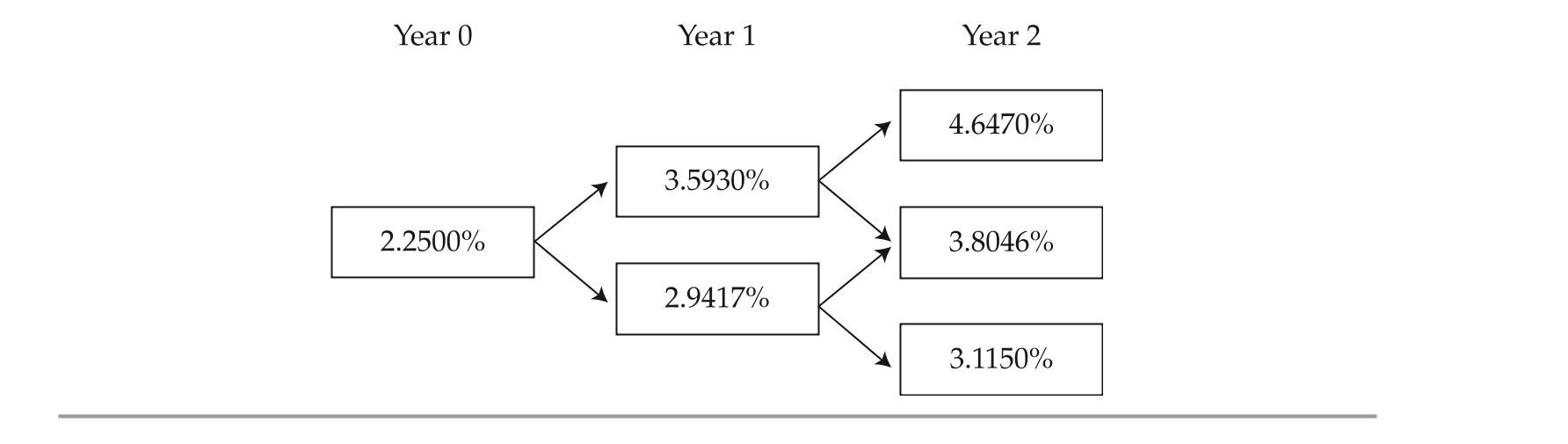

The one-year, two-year, and three-year par rates are 2.250%, 2.750%, and 3.100%, re-spectively. Based on an estimated interest rate volatility of 10%, ferguson constructs the bino-mial interest rate tree shown in Exhibit 2.

EXHiBiT 2 Binomial interest Rate Tree

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

EXHiBiT 3 Convertible Bond issued by Pro Star, inc.

-The value of Bond 2 is closest to:

Definitions:

Sacco and Vanzetti Case

was a controversial legal case in the early 20th century United States, where Nicola Sacco and Bartolomeo Vanzetti, Italian-born American anarchists, were tried and executed for robbery and murder, a trial widely regarded as flawed and motivated by political bias.

Political Biases

The tendency to favor or support particular political parties, ideologies, or candidates based on personal preferences rather than objective evidence.

Ethnic Biases

Involves prejudice or favoritism towards certain ethnic groups over others, often resulting in discrimination or social inequality.

Domestic Technology

Technology and appliances designed for use in the home to improve living conditions and reduce household labor, such as kitchen appliances, cleaning devices, and home entertainment systems.

Q1: distributed loading on beam ABCD is to

Q3: a characteristic of negotiable certificates of deposit

Q9: based on exhibits 3 and 4, the

Q14: When the investor's investment horizon is less

Q20: Select the curve represented by the

Q20: Describe the behavior of the function

Q30: The risk that a bond's creditworthiness declines

Q45: State the period of the function.

Q52: Use a graphing utility to select

Q54: The forward rate for a one-year loan