The following information relates to Questions 1-10

Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies. on 1 october 20X0, Steele ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating.

EXHiBiT 1 fixed-Rate Bonds issued by Pro Star, inc.

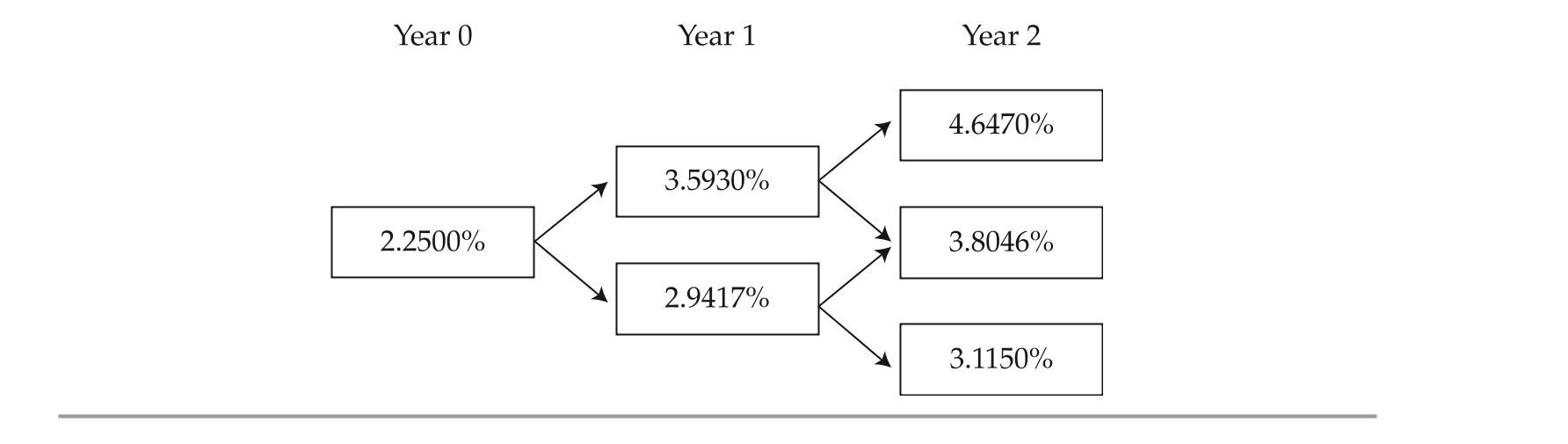

The one-year, two-year, and three-year par rates are 2.250%, 2.750%, and 3.100%, re-spectively. Based on an estimated interest rate volatility of 10%, ferguson constructs the bino-mial interest rate tree shown in Exhibit 2.

EXHiBiT 2 Binomial interest Rate Tree

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

EXHiBiT 3 Convertible Bond issued by Pro Star, inc.

-The conversion price of the bond in Exhibit 3 is closest to:

Definitions:

Achievement Motive

A psychological construct that refers to an individual's desire to achieve success and demonstrate competence.

Achievement Motivation

A psychological factor that drives individuals to seek success and accomplishment in their endeavors.

Implicit Motives

Unconscious desires, preferences, or needs that influence an individual's behavior without their explicit awareness.

Projective Technique

A psychological assessment method in which individuals reveal their underlying motives, feelings, and attitudes through the interpretation of ambiguous stimuli.

Q2: Which of the following bond types provides

Q3: which approach to its total return mandate

Q7: <span class="ql-formula" data-value="\text { A pipe }

Q7: a "buy-and-hold" investor purchases a fixed-rate bond

Q8: Select the graph of the function.

Q10: steel tube with diameters <span

Q18: investors who believe that interest rates will

Q18: If a mortgage borrower makes prepayments without

Q24: Consider the following two bonds that

Q44: The expected loss for a given debt