The following information relates to Questions 1-10

Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies. on 1 october 20X0, Steele ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating.

EXHiBiT 1 fixed-Rate Bonds issued by Pro Star, inc.

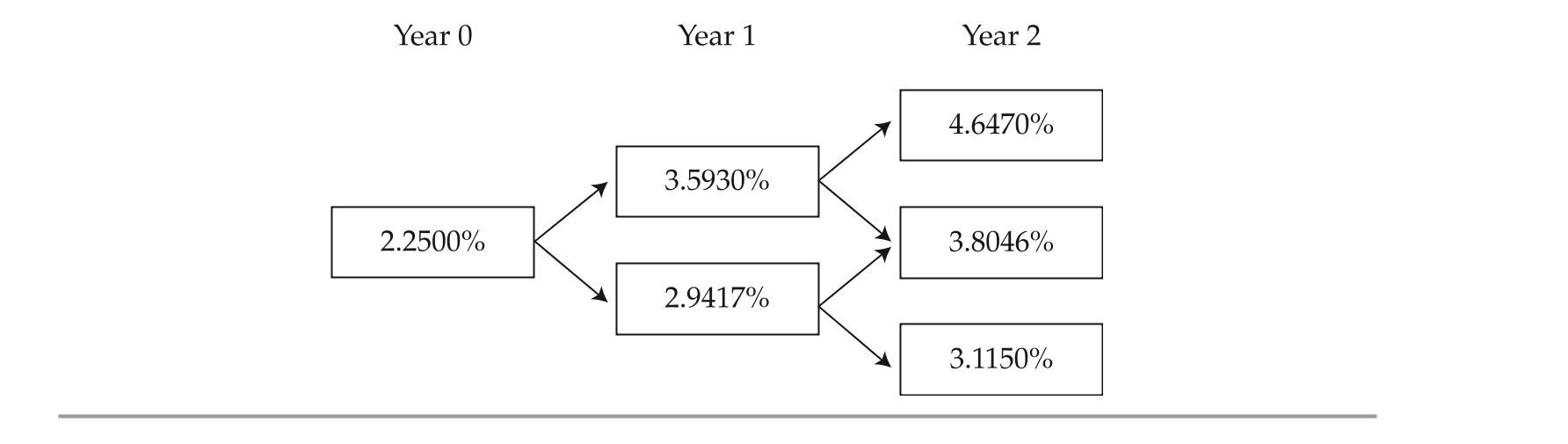

The one-year, two-year, and three-year par rates are 2.250%, 2.750%, and 3.100%, re-spectively. Based on an estimated interest rate volatility of 10%, ferguson constructs the bino-mial interest rate tree shown in Exhibit 2.

EXHiBiT 2 Binomial interest Rate Tree

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

EXHiBiT 3 Convertible Bond issued by Pro Star, inc.

-if the market price of Pro Star's common stock falls from its level on 19 october 20X0, the price of the convertible bond will most likely:

Definitions:

Profit

The financial gain achieved when the revenue from business activities exceeds the expenses, costs, and taxes involved in maintaining the operation.

Operating Loss

A financial metric representing the negative balance resulting from a company's operating expenses exceeding its revenues.

Variable Cost

Costs that change in proportion to the level of activity or volume of goods produced, such as raw materials and labor expenses.

Fixed Costs

Expenses that remain constant regardless of the amount of output or sales, including costs like lease payments, wages, and insurance premiums.

Q8: Find <span class="ql-formula" data-value="a"><span class="katex"><span

Q10: based on edgarton's expectation for the yield

Q13: Evaluate the limit. <span class="ql-formula"

Q23: The forward rate for a two-year loan

Q27: a 10-year, capital-indexed bond linked to the

Q37: For the simple harmonic motion described

Q45: Use the figure to find the

Q52: Use the half-angle formulas to determine

Q91: Select the graph of the polar

Q107: Classify the function as a Polynomial