The following information relates to Questions 11-19

Rayes investment Advisers specializes in fixed-income portfolio management. Meg Rayes, the owner of the firm, would like to add bonds with embedded options to the firm's bond port-folio. Rayes has asked Mingfang Hsu, one of the firm's analysts, to assist her in selecting and analyzing bonds for possible inclusion in the firm's bond portfolio.Hsu first selects two corporate bonds that are callable at par and have the same character-istics in terms of maturity, credit quality and call dates. Hsu uses the option-adjusted spread(oAS) approach to analyse the bonds, assuming an interest rate volatility of 10%. The resultsof his analysis are presented in Exhibit 1.

EXHIBIT 1 Summary Results of Hsu's Analysis Using the OAS Approach

Hsu then selects the four bonds issued by Rw, inc. given in Exhibit 2. These bonds all have a maturity of three years and the same credit rating. Bonds 4 and 5 are identical to Bond3, an option-free bond, except that they each include an embedded option.

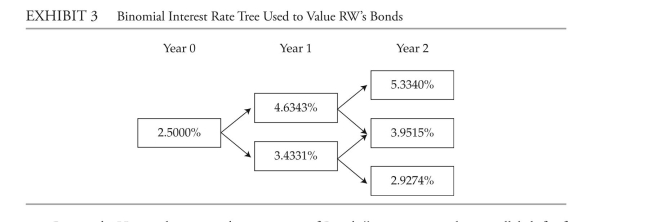

To value and analyze Rw's bonds, Hsu uses an estimated interest rate volatility of 15% and constructs the binomial interest rate tree provided in Exhibit 3.

Rayes asks Hsu to determine the sensitivity of Bond 4's price to a 20 bps parallel shift ofthe benchmark yield curve. The results of Hsu's calculations are shown in Exhibit 4.EXHiBiT 4 Summary Results of Hsu's Analysis about the Sensitivity of Bond 4's Price to a ParallelShift of the Benchmark yield Curve Magnitude of the Parallel Shift in the Benchmark yield Curve +20 bps −20 bps full Price of Bond 4 (% of par) 100.478 101.238 Hsu also selects the two floating-rate bonds issued by Varlep, plc given in Exhibit 5. These

bonds have a maturity of three years and the same credit rating.

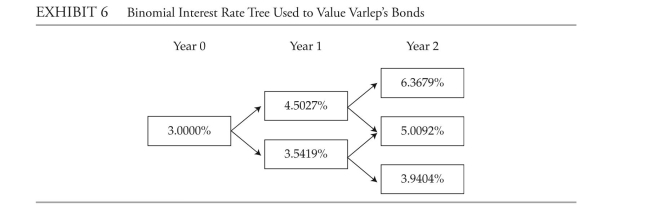

To value Varlep's bonds, Hsu constructs the binomial interest rate tree provided inExhibit 6.

last, Hsu selects the two bonds issued by whorton, inc. given in Exhibit 7. These bonds are close to their maturity date and are identical, except that Bond 9 includes a conversion option. whorton's common stock is currently trading at $30 per share.

-The value of Bond 9 is equal to the value of Bond 10:

Definitions:

Fixed Cost

An expense that remains constant regardless of the volume of products or services manufactured or distributed.

Relevant Range

The range of activity within which assumptions about variable and fixed cost behavior are valid.

Volume of Activity

Refers to the level of operations or the amount of output produced or services rendered in a certain period.

Fixed Cost

Costs that remain constant in total regardless of changes in the level of activity or volume of production.

Q3: based on exhibits 1 and 2, which

Q3: in the presentation, lok is asked why

Q3: In a securitization, the special purpose entity

Q5: is Perreaux correct with respect to key

Q12: Use the formula <span class="ql-formula"

Q15: A cylindrical tank is assembled by

Q15: Which of gerber's three differences about investing

Q17: Find the distance between the point

Q27: Based on Exhibit 1, for the Bi

Q38: Use the Law of Sines to