The following information relates to Questions 1-6

katrina black, portfolio manager at Coral bond Management, ltd., is conducting a training session with alex Sun, a junior analyst in the fixed income department. black wants to ex-plain to Sun the arbitrage-free valuation framework used by the firm. black presents Sun with exhibit 1, showing a fictitious bond being traded on three exchanges, and asks Sun to identify the arbitrage opportunity of the bond. Sun agrees to ignore transaction costs in his analysis.exhibit 1 Three-Year, €100 par, 3.00% Coupon, annual-Pay option-Free bond

black shows Sun some exhibits that were part of a recent presentation. exhibit 3 presents most of the data of a binomial lognormal interest rate tree fit to the yield curve shown in ex-hibit 2. exhibit 4 presents most of the data of the implied values for a four-year, option-free, annual-pay bond with a 2.5% coupon based on the information in exhibit 3.exhibit 2 Yield to Maturity Par rates for one-, two-, and Three-Year annual-Pay option-Free bonds

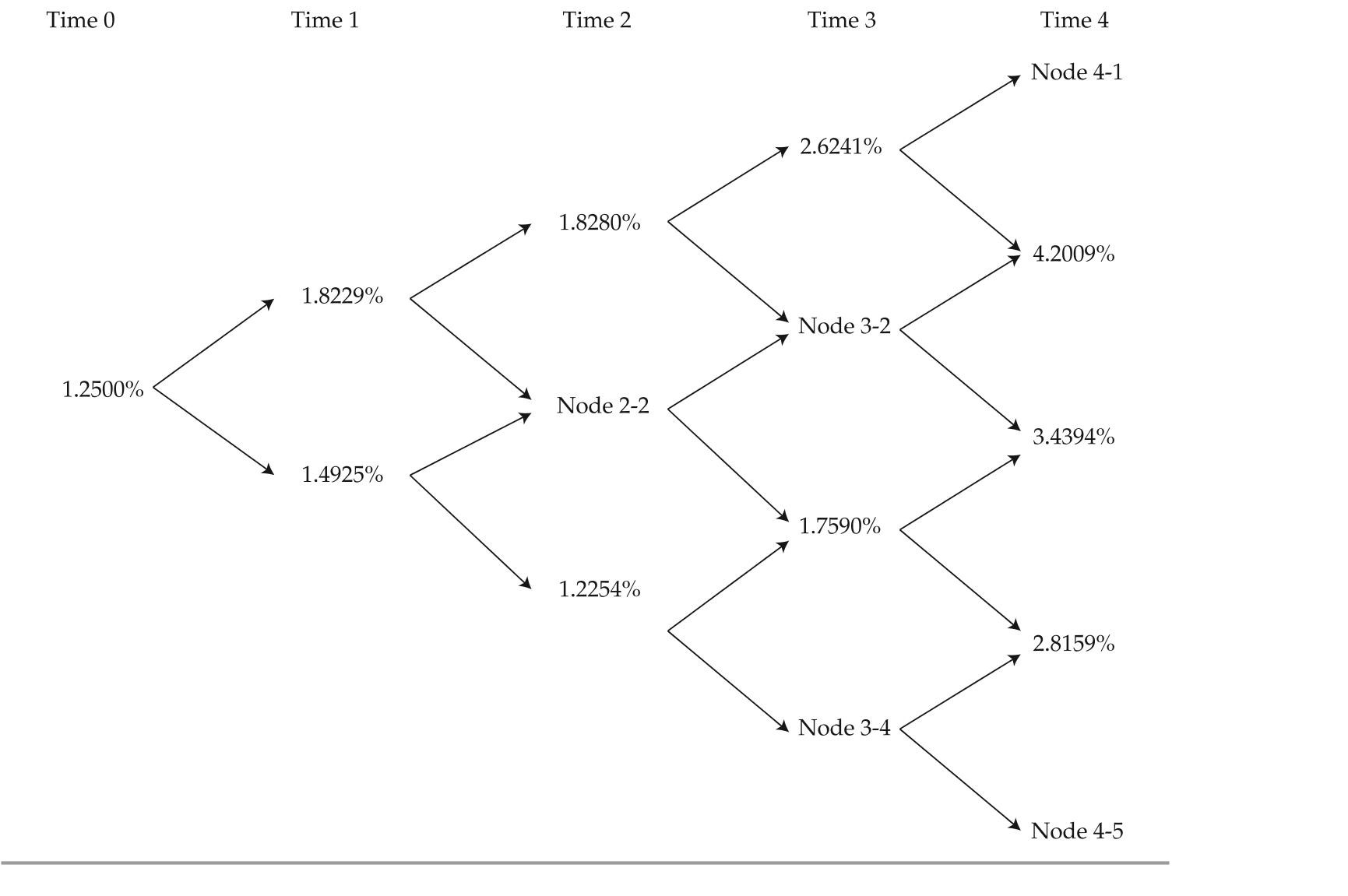

exhibit 3 binomial interest rate tree Fit to the Yield Curve (Volatility = 10%)

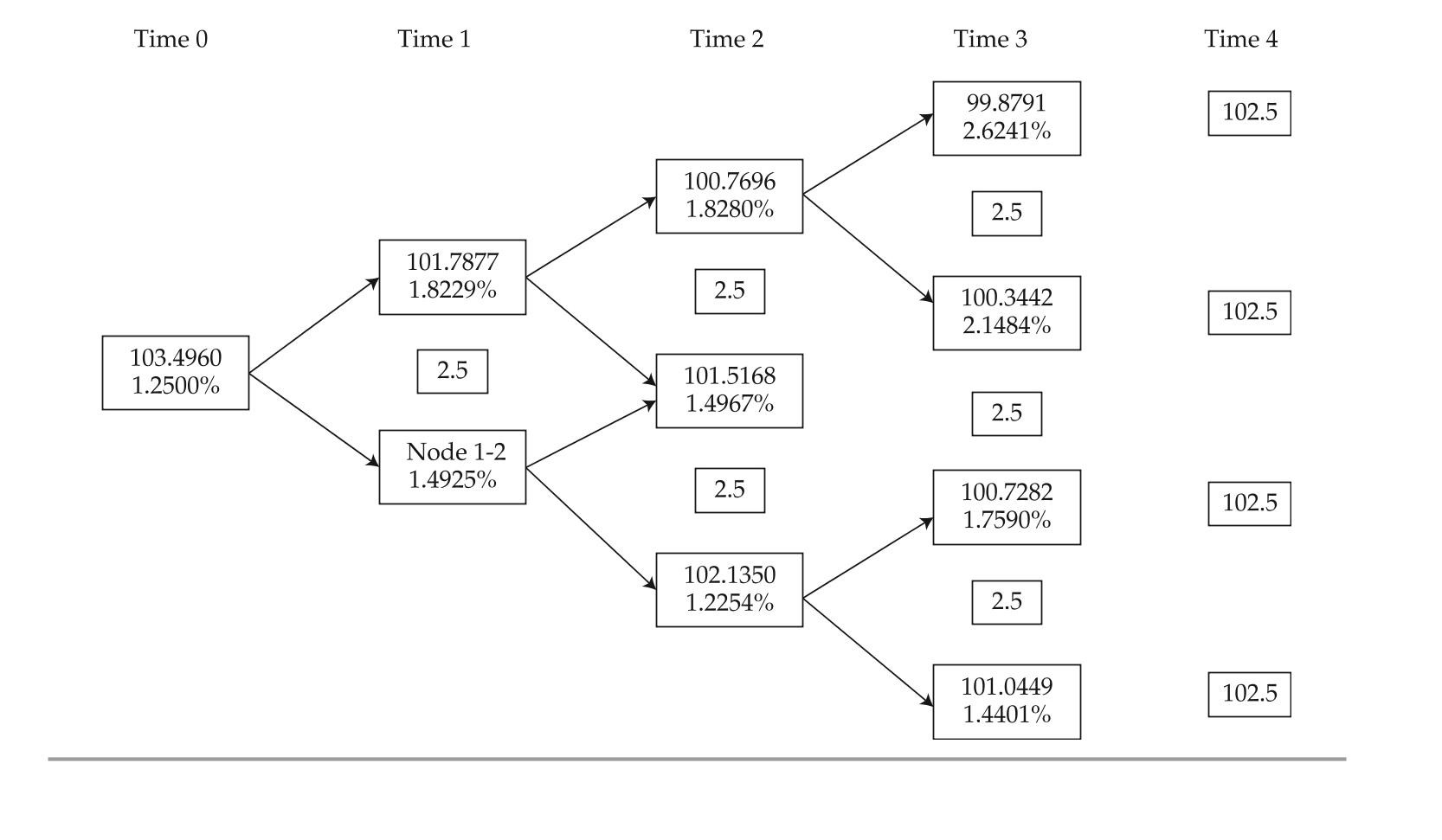

exhibit 4 implied Values (in euros) for a 2.5%, Four-Year, option-Free, annual-Pay bond based on exhibit 3

exhibit 4 implied Values (in euros) for a 2.5%, Four-Year, option-Free, annual-Pay bond based on exhibit 3

black asks about the missing data in exhibits 3 and 4 and directs Sun to complete the following tasks related to those exhibits:

black asks about the missing data in exhibits 3 and 4 and directs Sun to complete the following tasks related to those exhibits:

task 1 test that the binomial interest tree has been properly calibrated to be arbitrage-free.

task 2 Develop a spreadsheet model to calculate pathwise valuations. to test the ac-curacy of the spreadsheet, use the data in exhibit 3 and calculate the value of the bond if it takes a path of lowest rates in Year 1 and Year 2 and the second lowest rate in Year 3.

task 3 identify a type of bond where the Monte Carlo calibration method should be used in place of the binomial interest rate method.

task 4 update exhibit 3 to reflect the current volatility, which is now 15%.

-based on exhibit 1, the best action that an investor should take to profit from the arbitrage opportunity is to:

Definitions:

Beneficiary

An individual or entity entitled to benefits or proceeds from a will, trust, insurance policy, or other contract.

Open Policies

Insurance policies that do not fix the value of the insured cargo but leave it to be ascertained in case of loss.

Fair Market Value

The price at which an asset would change hands between a willing buyer and seller, each having reasonable knowledge of relevant facts, and neither being under compulsion to buy or sell.

Material Facts

Facts that are significant or essential to the issue at hand, and that can influence a decision or outcome.

Q11: Which type of bond most likely earns

Q13: nonprismatic cantilever bar has an internal

Q16: The legal contract that describes the form

Q19: based on exhibit 1, Kiest's liabilities would

Q23: The minimum value of Bond 9 is

Q26: Use the given values to evaluate

Q41: Evaluate the following expression. <span

Q42: Suppose that <span class="ql-formula" data-value="F

Q50: Select the graph of the polar

Q138: Let <span class="ql-formula" data-value="F (