The following information relates to Questions

betty tatton is a fixed income analyst with the hedge fund Sailboat asset Management (SaM) .SaM invests in a variety of global fixed-income strategies, including fixed-income arbitrage.tatton is responsible for pricing individual investments and analyzing market data to assess the opportunity for arbitrage. She uses two methods to value bonds:

Method 1: Discount each year's cash flow separately using the appropriate interest rate curve.

Method 2: build and use a binomial interest rate tree.

tatton compiles pricing data for a list of annual pay bonds (exhibit 1) . each of the bonds will mature in two years, and tatton considers the bonds as being risk-free; both the one-year and two-year benchmark spot rates are 2%. tatton calculates the arbitrage-free prices and identifies an arbitrage opportunity to recommend to her team.exhibit 1 Market Data for Selected bonds

next, tatton uses the benchmark yield curve provided in exhibit 2 to consider arbitrage opportunities of both option-free corporate bonds and corporate bonds with embedded op-tions. The benchmark bonds in exhibit 2 pay coupons annually, and the bonds are priced at par.exhibit 2 benchmark Par Curve

tatton then identifies three mispriced three-year annual-pay bonds and compiles data onthe bonds (see exhibit 3) .

exhibit 3 Market Data of annual-Pay Corporate bonds

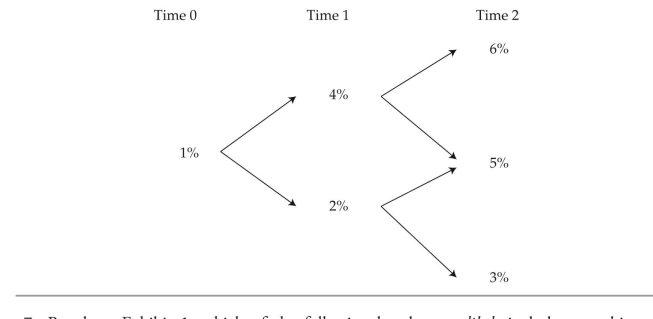

last, tatton identifies two mispriced Swiss bonds, ond x, a three-year bond, and bond Y, a five-year bond. both are annual-pay bonds with a coupon rate of 6%. to calculate the bonds' values, tatton devises the first three years of the interest rate lognormal tree presented in exhibit 4 using historical interest rate volatility data. tatton considers how these data would change if implied volatility, which is higher than historical volatility, were used instead.

exhibit 4 interest rate tree; Forward rates based on Swiss Market

-based on exhibit 4 and using Method 2, the correct price for bond x is closest to:

Definitions:

Perfectly Price-inelastic

A situation where the quantity demanded of a good does not change regardless of changes in its price.

Price-inelastic

Referring to a situation where demand or supply for a good or service is relatively unresponsive to changes in price.

Total Revenue

The aggregate income a company generates from its sales of products or delivery of services over a designated period.

Price Falls

A decrease in the market price of a good or service, which can affect consumer demand, producer supply, and overall market equilibrium.

Q2: Find the center and vertices of

Q2: following the Maxx restructuring, the CdX hY

Q9: are foster's statements to deveraux supporting foster's

Q10: Use the given values to evaluate

Q13: The two components of credit risk are

Q21: A fixed income analyst is least likely

Q40: Select the correct equation of the

Q54: Determine whether the Law of Sines

Q118: <span class="ql-formula" data-value="\text { Determine whether the

Q133: If <span class="ql-formula" data-value="\lim _