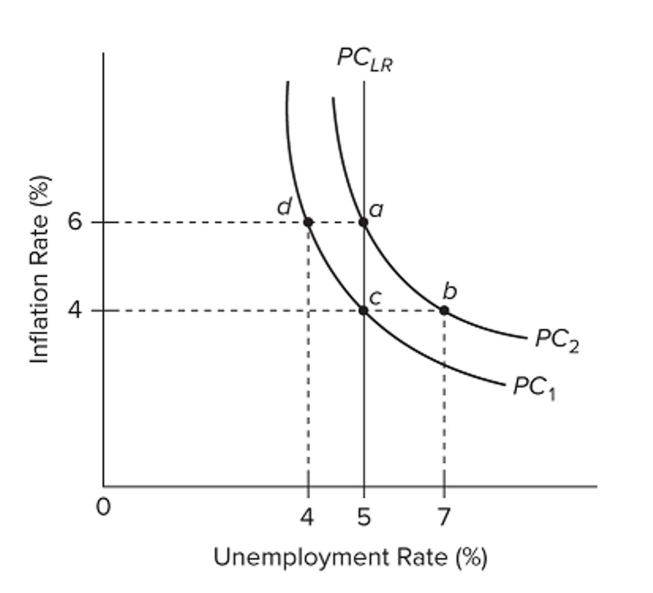

Refer to the diagram. Assume that the natural rate of unemployment is 5 percent and that the economy is initially operating at point a, where the expected and actual rates of inflation are each 6

Refer to the diagram. Assume that the natural rate of unemployment is 5 percent and that the economy is initially operating at point a, where the expected and actual rates of inflation are each 6

Percent. In the long run, the decline in the actual rate of inflation from 6 percent to 4 percent will

Definitions:

Export Transactions

Commercial activities that involve selling goods or services to a buyer in another country.

Legal Jurisdiction

The authority given to a legal body like a court to administer justice within a defined field of responsibility, geographically or subject-wise.

Contractual Relations

The legal bonds and obligations that arise from agreements made between two or more parties.

International Rules

Regulations, standards, or guidelines that govern relations or activities between different countries, such as trade, maritime law, or diplomatic relations.

Q63: Mutual funds may contain<br>A) stocks only.<br>B) bonds

Q65: Mainstream economists believe that economic instability is

Q90: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" A) supply creates

Q108: Suppose two corporate bonds with similar risk

Q127: The equation of exchange is MV =

Q168: The idea that the economy will self-correct

Q176: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg" alt=" Refer

Q178: If the Fed raises the interest rates

Q231: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" Refer to the

Q274: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" Refer to the