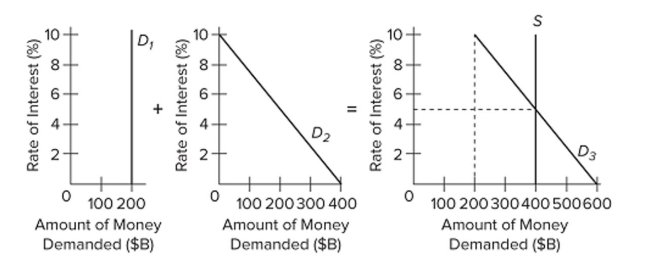

Refer to the given market-for-money diagrams. If the Federal Reserve increased the stock of money, the

Refer to the given market-for-money diagrams. If the Federal Reserve increased the stock of money, the

Definitions:

Face Value

The nominal or dollar value printed on a security or currency, indicating its worth as stated by the issuing authority.

Yield To Maturity

The total return anticipated on a bond if it is held until the date it matures, including all payments of interest and principal.

5-Year Bond

A debt security issued by governments or corporations with a fixed interest rate and maturity period of five years.

Forward Rate

The future interest rate agreed upon in a forward contract, relating to loans, bonds, or deposits to be made at a specified future time.

Q28: What is the Laffer curve? Explain the

Q45: The process of arbitrage<br>A) raises or lowers

Q106: The most frequently used instrument of the

Q175: The discount rate is the interest<br>A) rate

Q187: Assume that a single commercial bank has

Q199: Jacob is holding an investment he bought

Q206: What are the implications of a liquidity

Q244: If there is a 2 percent unemployment

Q276: Repos are a tool used by the

Q397: If the Fed wants to maintain current