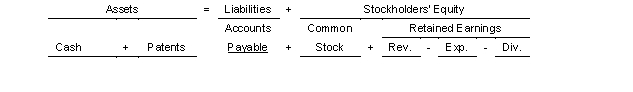

On July 1 2018 Graunke Company purchased a patent from Chimney Rock Company for $8000000.It was estimated that the patent has a remaining useful life of 4 years.On July 1 2022 Graunke retired the asset.Use the following tabular analysis to make the adjustment for retirement assuming that the cost has been fully amortized.

Definitions:

Payroll Accrual

An accounting method that records payroll expenses incurred but not yet paid out to employees, ensuring expenses are recognized in the period they are incurred.

Accounting Period

The span of time covered by financial statements, often a quarter or year, reflecting the company's financial performance and position.

Accrual Entry

An accounting method that records revenues and expenses when they are incurred, regardless of when cash is exchanged.

Accounting Accruals

Accounting method where revenue and expenses are recorded when they are earned or incurred, not necessarily when cash is received or paid.

Q11: Information that is presented in a clear

Q16: Management may choose any inventory costing method

Q51: Which one of the following items would

Q56: If goods in transit are shipped FOB

Q85: For accounting purposes stated value is treated

Q139: Cash realizable value is determined by subtracting

Q152: A truck costing $75000 and on which

Q159: The most generally accepted measurement value used

Q169: Each of the following is a feature

Q205: As interest is recorded on an interest-bearing