Reference: Ref 17-2

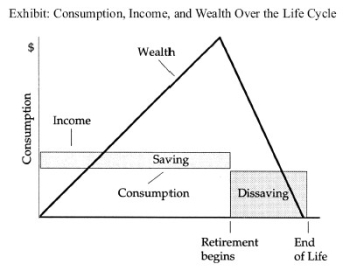

(Exhibit: Consumption, Income, and Wealth Over the Life Cycle) Consider the stylized pattern of lifetime income, consumption, saving, dissaving, and wealth shown in the above graph. Assume that consumption is constant over the entire lifetime, income is constant over working lifetime, the real interest rate is zero, and there is no uncertainty about life span.

a. If there is no population growth, the ratio of wealth to income will be constant for the nation. If all individuals live T years and work R years, the amount of wealth accumulated at the time of retirement must be enough for T - R years of consumption (C per year). What is the formula for the ratio of average wealth over the whole life cycle W to consumption per year, as a function of T and R? That is, what is

W/C expressed in terms of T and R?

b. If T = 50 and R = 40, what is the numerical value of W/C?

Definitions:

Monthly Mortgage

A regularly scheduled payment that often includes both interest and principal, made by a borrower to a lender for the repayment of a home loan.

Interest Rate

The percentage rate that is paid by a bank on money that is in some accounts.

Monthly Payment

A specified amount of money paid at regular monthly intervals, typically associated with loans or installment purchases.

Quoted Interest Rate

The interest rate that a lender offers to a borrower for a loan, not accounting for compounding or additional fees.

Q11: Long-run growth the demand for goods and

Q14: Cost-push inflation is the result of:<br>C)high aggregate

Q15: The assumption of continuous market clearing means

Q16: An economy's factors of production and its

Q29: In 2008 and 2009, the U.S. Treasury

Q32: In the Baumol-Tobin model, the benefit of

Q33: If MPC = 0.75 (and there are

Q39: If the IS curve is given by

Q60: In the classical model with fixed income

Q62: According to the neoclassical model of investment,