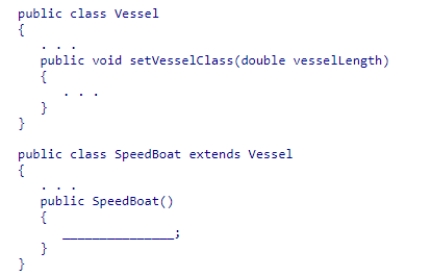

Insert the missing code in the following code fragment.This fragment is intended to call the Vessel class's method.

Definitions:

Put Option

A financial contract that gives the holder the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specified time.

Hedge Ratio

The ratio of the size of a position in a hedging instrument to the size of the position being hedged, intended to minimize risk.

Black-Scholes

A mathematical model used to estimate the price of European-style options, factoring in variables such as stock price, strike price, volatility, time to expiry, and risk-free rate.

Long Call Option

A bullish strategy in which an investor buys a call option to profit from a rise in the price of the underlying asset.

Q1: What are the five Cs of pricing

Q6: In most states you can contact the

Q7: Discuss the advantages to a retailer like

Q7: The for loop header can contain multiple

Q18: How successful would you say Shoppers Service

Q22: Should Tana (a young entrepreneur), launching a

Q27: Suppose you wish to use an array

Q48: Consider the following code snippet.Which statement should

Q58: What is the output of the following

Q102: When hand tracing, drawing a line through