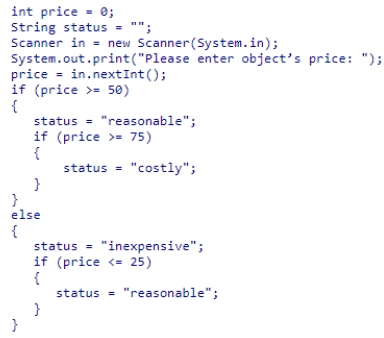

If the user enters 22 as the price of an object, which of the following hand-trace tables is valid for this code snippet?

Definitions:

Deferred Tax Liabilities

Future tax payments due to temporary differences between financial accounting and tax accounting practices.

Deferred Tax Assets

Assets on a company's balance sheet that may be used to reduce future tax liability resulting from temporary timing differences between accounting and tax treatments.

Current Tax Liabilities

Taxes owed to the government within the current fiscal year.

Temporary Difference

Refers to the differences that arise between the tax base of an asset or liability and its carrying amount in the financial statements, which will result in taxable or deductible amounts in future years.

Q11: Suppose the class Value is partially defined

Q17: What changes do you need to make

Q21: In SQL, _ is used to test

Q37: The binary search is more efficient than

Q38: Each object of a class has its

Q63: What is the purpose of the LIKE

Q69: Suppose you wish to write a method

Q84: Which statement is true about the following

Q85: What is result of evaluating the following

Q102: Java 7 introduced enhanced syntax for declaring