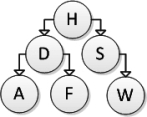

Consider the following binary search tree diagram:  Consider the following addNode method for inserting a newNode into a binary search tree:

Consider the following addNode method for inserting a newNode into a binary search tree:

public void addNode(Node newNode)

{

int comp = newnode.data.compareTo(data) ;

if (comp < 0)

{

if (left == null) {left = newNode;}

else { left.addNode(newNode) ; }

}

else

{

if (right == null) {right = newNode;}

else { right.addNode(newNode) ; }

}

}

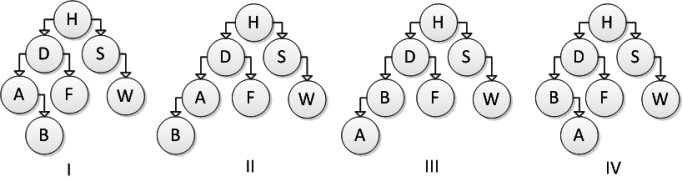

Which of the following trees represents the correct result after inserting element B, calling addNode on the root of the tree?

Definitions:

Q5: Which statement stores an integer value in

Q21: _ is often described as the has-a

Q27: The term "stale data" refers to a

Q29: Which of the following statements about the

Q32: What do object variables store?<br>A)objects<br>B)classes<br>C)object references<br>D)numbers

Q32: What code would be the most appropriate

Q64: Consider the following binary search tree diagram:

Q65: Assume that recursive method search returns true

Q66: Selection sort has O(n<sup>2</sup>) complexity.If a computer

Q70: One way to handle collisions in a