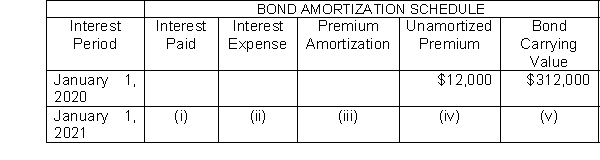

Presented here is a partial amortization schedule for Roseland Company which sold $300,000 of 5-year, 10% bonds on January 1, 2020, for $312,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (i) ?

Which of the following amounts should be shown in cell (i) ?

Definitions:

Variable Costing

An accounting method that considers only variable costs as product costs, with fixed costs treated as period costs.

Net Operating Income

A measure of a company's profitability, calculated by subtracting operating expenses from operating revenue.

Variable Costing

An accounting method that only allocates variable costs to inventory, treating fixed costs as period expenses that are charged to the income statement in the period they are incurred.

Absorption Costing

A method of inventory costing that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed manufacturing overheads - in the cost of a unit of product.

Q15: A Wage and Tax Statement shows gross

Q17: Stockholders' equity is often referred to as<br>A)residual

Q52: Townson Co.has outstanding $100 million of 7%

Q65: Small Company reported cost of goods sold

Q104: The body of theory underlying accounting is

Q114: Retained earnings restrictions are reported<br>A)in the footnotes

Q130: Employee payroll deductions include each of the

Q151: Stockholders' equity is decreased by all of

Q173: The declaration and distribution of a stock

Q219: If common stock is issued for an