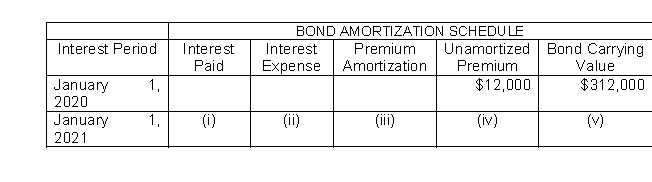

Presented here is a partial amortization schedule for Roseland Company which sold $300,000 of 5-year, 10% bonds on January 1, 2020, for $312,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (ii) ?

Which of the following amounts should be shown in cell (ii) ?

Definitions:

Absorption Costing

A costing method that includes all manufacturing costs, direct materials, direct labor, and both variable and fixed manufacturing overhead, in the cost of a product.

Cost Structure

The relative proportion of fixed, variable, and mixed costs in an organization.

Unit Product Cost

The total cost to produce one unit of product, including direct materials, direct labor, and manufacturing overhead.

Common Fixed Expenses

Expenses that remain constant in total amount and are not affected by changes in business activity level, shared across multiple business segments or products.

Q3: The accounting for warranty cost is based

Q13: Owners of business firms are the only

Q15: A worker views leisure and income as

Q27: Which of the following would be added

Q71: The ending retained earnings amount is shown

Q78: On January 1, Soft Corporation had 80,000

Q101: Accounting information is used only by external

Q114: The purchase of office equipment on credit

Q204: Cloud Manufacturing declared a 10% stock dividend

Q229: A $1,000 face value bond with a