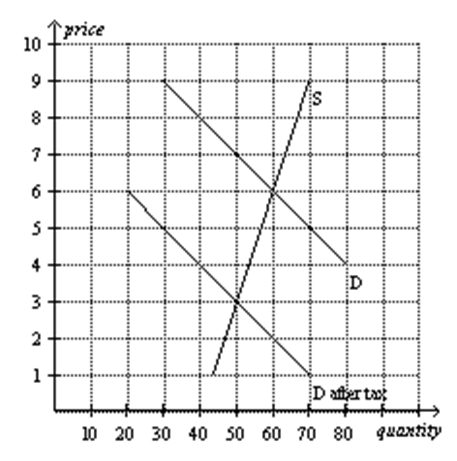

Using the graph below, answer the following questions:

a. What was the equilibrium price in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

Definitions:

Corporations

Businesses that are legally recognized as separate entities from their owners, having their rights and liabilities.

Q2: Cross-price elasticity of demand measures how the

Q6: The free rider problem<br>A) forces supply of

Q6: Subsidies are levied when a government wants

Q8: Antidrug media campaigns have a historical tie

Q22: Tradable pollution permits<br>A) reduce the incentive for

Q23: The future of crime-and-justice reality provides for

Q25: The appropriate tax rate to consider to

Q29: When firms enter a monopolistically competitive market

Q31: A tax that is placed on new

Q51: As the concentration ratio decreases, an oligopolistic