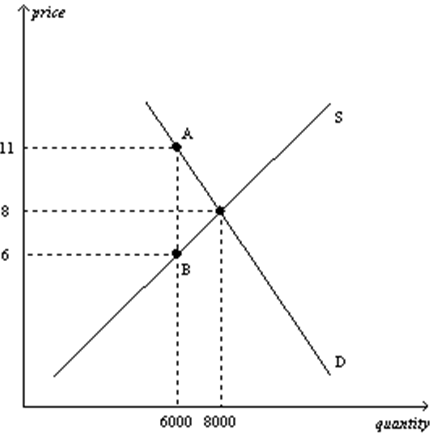

Using the graph below, in which the vertical distance between points A and B represents the tax in the market, answer the following questions:

a. What was the equilibrium price and quantity in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

Definitions:

Salivary Glands

Glands located in the mouth that produce saliva, which aids in digestion and keeps the mouth moist.

Pavlov's Analysis

Pertains to the research and experiments conducted by Ivan Pavlov, especially his work on classical conditioning, demonstrating how dogs could be conditioned to respond to a stimulus that previously had no effect on them.

Unconditioned Stimulus

An Unconditioned Stimulus is a stimulus that naturally and automatically triggers a response without any prior learning or conditioning.

Aquarium Light

An artificial lighting system designed to simulate natural light conditions in an aquarium, promoting the health and growth of aquatic plants and animals.

Q1: The existence of new media, in particular

Q1: Normative statements describe how the world is,

Q4: Surveillance systems are more effective in reducing

Q5: Firms that sell highly differentiated consumer products

Q8: The tax burden will fall most heavily

Q10: An efficient tax is one that generates

Q28: An individual's marginal tax rate equals<br>A) total

Q43: If the price elasticity of demand within

Q45: A corporation has been steadily losing money

Q59: A production function measures how<br>A) a firm