Scenario 13.1

Assume the following conditions hold.

a.At all banks, excess reserves are zero.

b.The deposit expansion multiplier is 3.

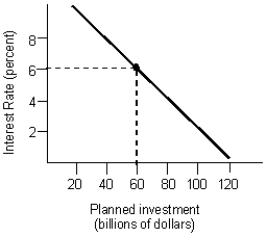

c.The investment spending function is as illustrated in the figure below.

Now the Federal Reserve engages in an open market operation by purchasing $1 billion worth of government bonds from private bond dealers, who then deposit the $1 billion in the banks. This acts to lower the equilibrium interest rate by 2 percent.

-Refer to Scenario 13.1. What is the change in required reserves following the open market operation by the Fed?

Definitions:

Boundary

A demarcation that marks the limits of an area or concept.

Intrasender Role Conflict

A situation where an individual receives conflicting demands or messages from the same source regarding their role.

Person-Role Conflict

A type of conflict experienced when an individual's personal values, beliefs, or needs are in contradiction with the expectations of their organizational role.

Intersender Role Conflict

A situation where an individual receives conflicting expectations or messages about their role from different sources, leading to stress and confusion.

Q17: An outward shift of the money demand

Q64: Reaction lag is the term used to

Q66: If a bank has deposits worth $800,000,

Q78: Which of the following is most likely

Q80: A key assumption of the Keynesian model

Q90: Which of the following will shift the

Q90: The time it takes for a particular

Q90: The quantity theory of money asserts that:<br>A)

Q104: Refer to Table 10.1. Assume that the

Q110: If the Fed aims to achieve a