Scenario 13.1

Assume the following conditions hold.

a.At all banks, excess reserves are zero.

b.The deposit expansion multiplier is 3.

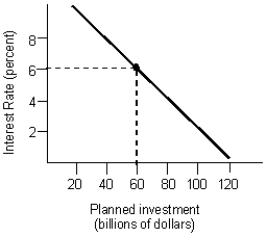

c.The investment spending function is as illustrated in the figure below.

Now the Federal Reserve engages in an open market operation by purchasing $1 billion worth of government bonds from private bond dealers, who then deposit the $1 billion in the banks. This acts to lower the equilibrium interest rate by 2 percent.

-Refer to Scenario 13.1. What is the change in required reserves following the open market operation by the Fed?

Definitions:

Nitrogen-Fixing Bacteria

Microorganisms that convert atmospheric nitrogen into a form that plants can absorb and utilize, such as ammonia.

Source-To-Sink

A concept describing the movement of materials or energy from a region of production (source) to a region of storage or consumption (sink) in organisms or ecosystems.

Pressure Flow

A hypothesis explaining the process by which sugars are transported in the phloem of plants from sources to sinks.

Active Transport

The movement of molecules across cell membranes from lower to higher concentration, requiring energy.

Q17: According to the new classical school, an

Q25: A by-product of the acceptance of the

Q37: The shape of the long-run Phillips curve

Q41: Refer to Table 12.2. If the reserve

Q50: Which of the following is true of

Q54: South Korea used an inward-oriented development strategy

Q76: In order to use inflation targeting, a

Q84: Other things equal, advances in technology make

Q109: Assume that an economy is in equilibrium

Q118: According to the information provided in Table