Heading: Analyzing Risky Decisions

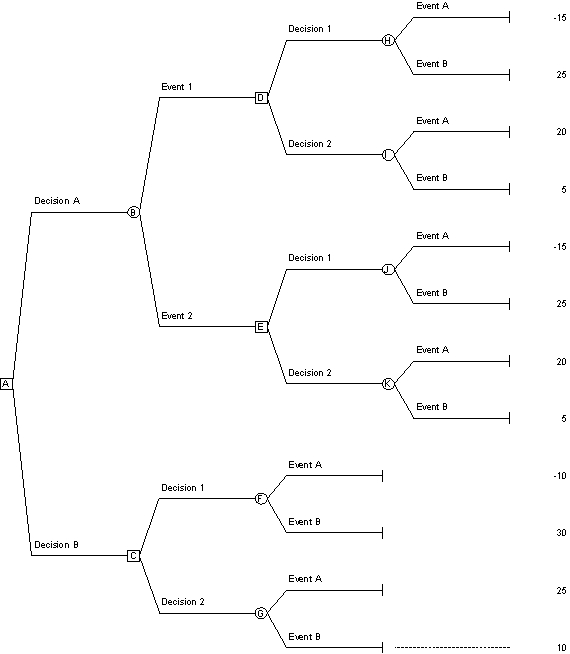

**Reference: Use the decision tree along with the given probabilities to answer the next six questions

Probability Event A = 30% Probability Event B = 70%

Probability Event 1 = 58% Probability Event 2 = 42%

Probability of Event A given that Event 1 occurs = 16%

Probability of Event B given that Event 1 occurs = 84%

Probability of Event A given that Event 2 occurs = 50%

Probability of Event B given that Event 2 occurs = 50%

-*What is the expected value at node B?

Definitions:

Cross-Hedging

A risk management strategy that involves hedging a position in one asset by taking a position in another asset with similar price movements.

Risk Profile

A description of an individual's or organization's willingness to take risks, as well as the threats to which they are exposed.

American Put Option

A type of options contract that gives the holder the right to sell a specified amount of an underlying security at a specified price within a specified time frame.

Exercise Price

The price set for buying or selling an asset under the terms of an option contract.

Q8: The Marketing Plan Coach software on the

Q18: How would differences in exchange rates between

Q18: Which of the following examples comes the

Q25: Government purchase programs in agriculture tend not

Q26: Negative externalities:<br>A)create a deadweight loss as do

Q38: A fixed cost that the firm cannot

Q43: Economic value added is defined as:<br>A)the same

Q58: Sunk costs do not affect the profit

Q60: In a perfectly competitive industry, individual firms

Q79: Acreage limitations are used by the government