Heading: Analyzing Risky Decisions

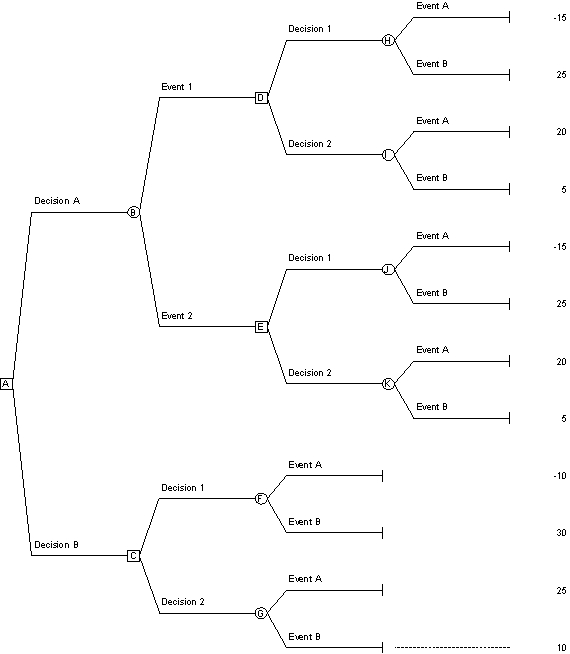

**Reference: Use the decision tree along with the given probabilities to answer the next six questions

Probability Event A = 30% Probability Event B = 70%

Probability Event 1 = 58% Probability Event 2 = 42%

Probability of Event A given that Event 1 occurs = 16%

Probability of Event B given that Event 1 occurs = 84%

Probability of Event A given that Event 2 occurs = 50%

Probability of Event B given that Event 2 occurs = 50%

-*If the cost of obtaining information to determine Event 1 and Event 2 is $5, what is the value of perfect information?

Definitions:

Interest Rate Differential

The difference in interest rates between two distinct economic or financial instruments.

Exchange Rate

The price of one currency in terms of another, crucial in international finance as it determines how much one currency is worth in another.

Political Risk

The risk of losing money due to changes in a country's political environment or policy.

Foreign Operations

Business activities and transactions conducted in countries other than the company's home country.

Q3: Review the Dell case at the beginning

Q4: The sum of the probabilities of all

Q11: What is an agent wholesaler's marketing mix?

Q15: In a perfectly competitive industry, individual firms

Q17: If a firm were interested in estimating

Q22: Suppose the market demand curve is

Q35: A monopolist faces an inverse demand

Q48: In Game 2 above,<br>A)Player A has a

Q53: Cournot competitors behave less aggressively than Bertrand

Q57: Consider a perfectly competitive market with