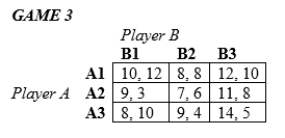

In the following games, all payoffs are listed with the row player's payoffs first and the column player's payoffs second.

-In Game 3 above,

Definitions:

Household Income

The total gross income before taxes of all household members over a certain age, typically used for financial assessments.

American Opportunity Tax

A credit that allows taxpayers to reduce their federal income tax based on qualified education expenses paid for themselves, a spouse, or a dependent.

Lifetime Learning Credits

A tax credit available to students enrolled in eligible educational institutions, aimed at reducing tax liability for tuition and certain related expenses.

AGI Amounts

AGI Amounts, or Adjusted Gross Income Amounts, represent an individual's total gross income minus specific deductions, used to determine how much of their income is taxable.

Q6: _ states that regardless of how property

Q6: An auction in which participants cry out

Q8: The Marketing Plan Coach software on the

Q10: How would officially granted monopolies affect the

Q12: In perfectly competitive markets there are no

Q35: The short-run supply curve for a firm

Q42: The reason why we sum the demand

Q43: Bertrand duopolists, Firm 1 and Firm

Q44: Suppose a $1 tax is levied on

Q67: Economic rent may equal economic profit.