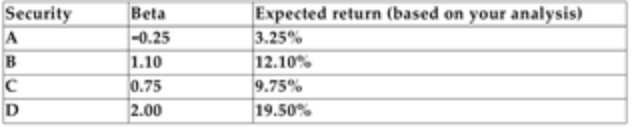

You have analyzed the following four securities and have estimated each security's beta and what you expect each security to return next year. The expected return on the market portfolio is 12%, and the relevant risk-free rate is 5%.

-Refer to the information above. Based on your analysis, which of the securities is correctly priced?

Definitions:

Social Constructivism

A theory in sociology and learning that emphasizes the importance of social interactions and culture in the construction of knowledge and understanding of the world.

Technology's Role

Refers to the impact and influence of technological advancements on various aspects of society and various sectors.

Bell Telephone Company

An early American telephone company founded by Alexander Graham Bell, which eventually became AT&T, playing a key role in the development and expansion of telecommunications in the United States.

Western Union

A financial services and communications company known for its money transfer services.

Q17: If the U.S. dollar depreciates relative to

Q20: 14 + (3 + 20)= (14 +

Q21: Consider the following three mutually exclusive projects:

Q34: Refer to the information above. Calculate the

Q36: The Thunderstruck Corporation paid $130,000 for an

Q60: <span class="ql-formula" data-value="\begin{array} { l } x

Q164: <span class="ql-formula" data-value="7 ^ { 2 }

Q240: <span class="ql-formula" data-value="x \cdot \frac { 1

Q268: -10 ·10<br>A)-200<br>B)-110<br>C)-100<br>D)-1000

Q269: <span class="ql-formula" data-value="( 13 ) ^ {