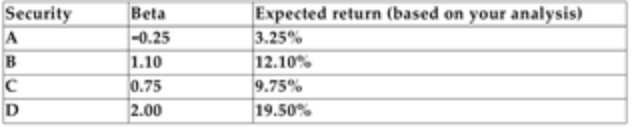

You have analyzed the following four securities and have estimated each security's beta and what you expect each security to return next year. The expected return on the market portfolio is 12%, and the relevant risk-free rate is 5%.

-Refer to the information above. Based on your analysis, which of the securities is (are) underpriced?

Definitions:

Equilibrium Price

The market price at which the quantity of a good supplied is equal to the quantity demanded, resulting in market equilibrium.

Marginal Cost

The augmentation in total cost triggered by the creation of one further unit of a product or service.

Equilibrium Price

The price at which the quantity of a good demanded by consumers equals the quantity supplied by producers, leading to a state of market equilibrium.

Equilibrium Price

The cost at which the amount of a product that buyers want to purchase matches the amount that sellers are willing to supply, creating equilibrium in the market.

Q21: <span class="ql-formula" data-value="f ( x ) =

Q26: Refer to the information above. A risk-averse

Q26: Project Hush will cost the Lullaby Company

Q35: Some real numbers are integers.

Q55: A project will cost $100,000 and is

Q61: The Security Market Line depicts the relationship

Q174: <span class="ql-formula" data-value="( - 5 x y

Q205: -3(-6)(-1)<br>A)-24<br>B)24<br>C)18<br>D)-18

Q245: <span class="ql-formula" data-value="( x ^{( - 2

Q281: (7)(-3)<br>A)-42<br>B)-11<br>C)-21<br>D)21