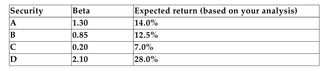

You have analyzed the following four securities and have estimated each security's beta and what you expect each security to return next year. The expected return on the market portfolio is 13%, and the relevant risk-free rate is 5.5%.

-Refer to the information above. Based on your analysis, which of the securities is correctly priced?

Definitions:

Normal Splitting

A physiological phenomenon where the heart's second sound (S2) separates into two distinct sounds during inhalation due to the delay in closure between the aortic and pulmonary valves.

Inspiration

The process of drawing air into the lungs, a vital part of the respiratory cycle.

Expiration

The process of expelling air out of the lungs during breathing; also refers to the end of a product's validity period.

Precordial Assessment

An evaluation of the front part of the lower chest wall, often to check for heart anomalies or abnormalities.

Q14: f(x)= 4x + 3<br>A)discontinuous at x

Q15: The risk-free rate is 4.2%, and the

Q38: Investors Mutual Fund reported a total 10-year

Q41: Refer to the information above. Calculate the

Q44: Which of the following comparisons of the

Q61: An investor who is risk-neutral<br>A)would prefer to

Q95: <span class="ql-formula" data-value="\begin{array} { l } 64

Q100: <span class="ql-formula" data-value="| - 10 |"><span class="katex"><span

Q136: <span class="ql-formula" data-value="f ( x ) =

Q153: <span class="ql-formula" data-value="\left| - \frac { 5