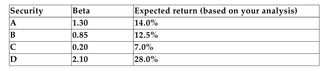

You have analyzed the following four securities and have estimated each security's beta and what you expect each security to return next year. The expected return on the market portfolio is 13%, and the relevant risk-free rate is 5.5%.

-Refer to the information above. Based on your analysis, which securities is (are) underpriced?

Definitions:

Web-Enabled

Refers to applications or services that are accessible or functional through the internet using web browsers.

Data Entry

The process of inputting information into electronic formats by typing or scanning, typically used in databases and computer systems.

FAIS

An acronym standing for Financial Advice and Intermediary Services, regulations aimed at protecting consumers by governing the provision of financial advice and intermediary services.

Information Silos

Isolated islands of data or information managed separately within an organization, leading to inefficiency and lack of synergy.

Q9: <span class="ql-formula" data-value="\frac { 3 x ^

Q27: An investment will cost $100 today. You

Q29: The following equally likely outcomes have been

Q36: Refer to the information above. What is

Q50: In which of the following two bonds

Q60: Refer to the information above. What is

Q77: 66,600,000<br>A) <span class="ql-formula" data-value="6.66 \times

Q108: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8419/.jpg" alt=" A

Q174: <span class="ql-formula" data-value="( - 5 x y

Q285: <span class="ql-formula" data-value="\sqrt { 42 }"><span class="katex"><span