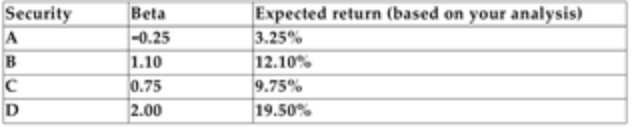

You have analyzed the following four securities and have estimated each security's beta and what you expect each security to return next year. The expected return on the market portfolio is 12%, and the relevant risk-free rate is 5%.

-Refer to the information above. Based on your analysis, which of the securities is correctly priced?

Definitions:

Social-Cognitive

A theoretical perspective that emphasizes the role of cognitive processes in understanding social behavior, including how we interpret, analyze, and remember information about the social world.

Vulnerable

A state of being open to harm, attack, or emotional hurt, often due to a lack of protection or defense.

Overthink

The act of thinking about something too much or for too long, often leading to excessive worry or analysis.

Internal

Relating to or situated on the inside; often refers to processes or qualities within an entity or organism.

Q3: The internal rate of return on a

Q13: A stock is currently selling for $32

Q14: Project Bertha requires an initial cost outlay

Q25: <span class="ql-formula" data-value="\begin{array} { l } x

Q30: Another name for the hedge ratio is

Q43: Consider the following mutually exclusive projects, all

Q45: Refer to the information above. What is

Q84: 7 - 10<br>A)3<br>B)-3<br>C)-17<br>D)17

Q182: x = 1 · x<br>A)inverse property of

Q305: The set of integers is an infinite