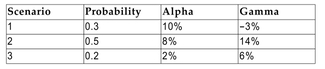

Consider the following information regarding Project Alpha and Project Gamma:  a. What is the expected return on Project Alpha?

a. What is the expected return on Project Alpha?

b. What is the expected return on Project Gamma?

c. If the relevant risk-free rate is 3.5% and the expected return on the market is 11%,

what is the CAPM expected return on Project Alpha if its estimated beta is 0.5?

d. Using the same assumptions as in part (c), what is the CAPM expected return on

Project Gamma if its estimated beta is 0.8?

e. Based on your previous calculations, in which project would you recommend your

firm invest? Why?

Definitions:

Nutrient-rich Blood

Blood that is especially high in essential nutrients like vitamins, minerals, and oxygen, essential for maintaining healthy bodily functions.

Umbilical Cord

The flexible cord-like structure connecting a fetus to the placenta, delivering nutrients and removing waste.

Placenta

A structure that forms in the uterus while pregnant, which supplies the fetus with oxygen and nourishment while eliminating its waste.

Developing Organism

refers to an organism in the stages of growth and development, from conception through to maturity.

Q14: Refer to the information above. Which of

Q20: A person at the top of

Q27: Which of the following events results in

Q29: Refer to the information above. What is

Q59: The empirical evidence suggests that<br>A)growth stocks tend

Q60: Write the general formula for the variance

Q73: <span class="ql-formula" data-value="f ( x ) =

Q87: <span class="ql-formula" data-value="f ( x ) =

Q184: <span class="ql-formula" data-value="\left[ ( - 7 )

Q199: The average distance of the planet