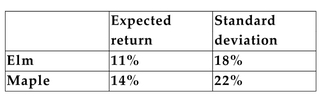

You have collected the following information for the returns of the Elm Corporation and the Maple Corporation:  The covariance of the returns of the two securities is 277.2%%.

The covariance of the returns of the two securities is 277.2%%.

-Refer to the information above. If you invest 40% of your money in Elm and 60% in Maple, what is the standard deviation of the returns on your portfolio?

Definitions:

Holding Companies

Entities created to own the outstanding stock of other companies, controlling their policies and management.

Subsidiary

A company that is completely or partly owned and partly or wholly controlled by another company.

Ownership

The state or fact of owning something, which can involve possessing property, shares in a company, or any asset that grants the owner legal rights and responsibilities.

Horizontal Mergers

A business consolidation that occurs between firms that operate in the same industry or production stage.

Q2: Assume a U.S. company has a project

Q20: You invest in 200 shares of Canso

Q21: A bond investment yielded 8%. If inflation

Q21: Refer to the information above. This new

Q23: A $20,000, level-coupon Eurobond pays interest annually

Q31: What is meant by "limited liability" in

Q35: Refer to the information above. A risk-averse

Q48: What is inflation and how is it

Q57: In the United States, most contracts are

Q159: <span class="ql-formula" data-value="\{ 1,3,5,7 , \ldots \}"><span