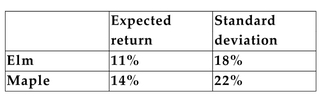

You have collected the following information for the returns of the Elm Corporation and the Maple Corporation:  The covariance of the returns of the two securities is 277.2%%.

The covariance of the returns of the two securities is 277.2%%.

-Refer to the information above. If you invest 40% of your money in Elm and 60% in Maple, what is the standard deviation of the returns on your portfolio?

Definitions:

P-value Approach

A method in hypothesis testing that uses the p-value, the probability of obtaining test results at least as extreme as the observed, under the assumption the null hypothesis is true.

Critical Values

Specific points along the scale of a test statistic that delineate the acceptance or rejection of the null hypothesis.

Two-Tailed Hypothesis

A statistical test where the area of interest lies in both tails of the distribution, testing for the possibility of a relationship in both directions.

Level of Significance

A threshold used to decide whether a hypothesis test results are statistically significant.

Q17: The writer of a put option<br>A)has the

Q31: The stock of the Delta Corporation has

Q39: Assume the prevailing interest rate is 12%

Q44: <span class="ql-formula" data-value="f ( x ) =

Q51: You purchased a stock for $60 a

Q54: Distinguish between inside directors and outside directors.

Q59: When considering the historical performance of a

Q117: <span class="ql-formula" data-value="( 9 x ) ^

Q143: -160 ÷ (-8)<br>A) <span class="ql-formula"

Q300: <span class="ql-formula" data-value="( 2 ) ^ {