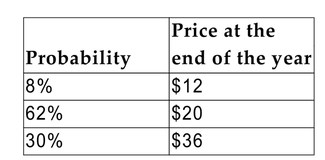

The price of a stock in one year has been assigned the following probability distribution:  What is the expected price of the stock?

What is the expected price of the stock?

Definitions:

Risk-Free Rate

The return on investment with no risk of financial loss, traditionally associated with government bonds.

Expected Rate

The anticipated rate of return on an investment, often based on historical data or statistical analysis.

Market Risk Premium

The additional return investors expect for holding a risky market portfolio instead of risk-free assets.

Risk-Free Rate

The hypothetical return on a risk-free investment, typically illustrated by the interest earned on government securities.

Q7: Empirical evidence indicates that legal accounting earnings

Q18: When individuals act in their own personal

Q42: The most difficult CAPM input to estimate

Q49: Which of the following statements about put

Q50: Jolene has just become entitled to receive

Q53: The 1-year Treasury rate is 2.7%, and

Q101: -1.4 ÷ 0.07<br>A)-20<br>B)-1.33<br>C) <span class="ql-formula"

Q122: 12(-10)<br>A)-120<br>B)-132<br>C)-220<br>D)-1200

Q217: <span class="ql-formula" data-value="\frac { - b +

Q295: <span class="ql-formula" data-value="\frac { 6 \times 10