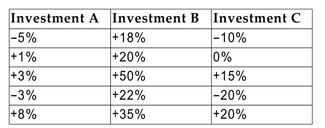

The possible one-year returns for three different investments are as follows:  The returns for each investment are equally likely to occur. Which investment's

The returns for each investment are equally likely to occur. Which investment's

returns would have the lowest standard deviation? Why? (Note: No calculations are

necessary.)

Definitions:

Bad Debts Expense

Bad debts expense represents the portion of receivables that a company estimates it will not be able to collect.

Allowance for Doubtful Accounts

An accounting provision made by companies to account for potential future bad debts, reflecting credit sales that might not be collected.

Write Off

The accounting action of declaring that an asset is no longer useful and recording its depreciation in the financial statements.

Expense Recognition Principle

An accounting principle that matches expenses with the revenues they helped to generate, recognizing expenses in the same period as the revenues.

Q12: The entrenched management of a $300 million,

Q23: Your firm uses 30% debt financing and

Q24: A corporate bond promises to pay $5,000

Q38: <span class="ql-formula" data-value="3 x ^ { 2

Q38: Project Thor requires an initial investment of

Q39: Project Epsilon requires an initial cash outlay

Q55: Which of the following would be a

Q55: A company that offers a friendly takeover

Q60: Which of the following statements regarding projects

Q272: Is I a subset of Q?<br>A)Yes<br>B)No