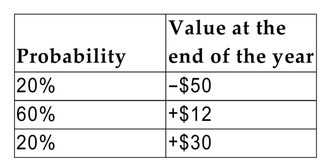

You have estimated a probability distribution for the value of an investment one year from now.  Calculate the expected value and the standard deviation of the future values for the

Calculate the expected value and the standard deviation of the future values for the

Investment.

Definitions:

Short-Run Phillips

A theoretical framework that implies a short-term inverse correlation between inflation rates and unemployment levels.

Classical Dichotomy

The theoretical separation of nominal and real variables in an economy, suggesting that changes in the money supply only affect nominal variables and not real variables like output.

Fiscal Policy

Modifications by the government in its expenditure and tax policies to impact the country's economic conditions.

Short-Run Phillips

A concept describing the inverse relationship between unemployment and inflation in the short run.

Q2: "Tunneling" refers to<br>A)the use of illegal accounting

Q2: A firm currently pays a dividend of

Q6: Consider the following term structure: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8263/.jpg"

Q10: A project is expected to produce a

Q30: If the current exchange rate is 0.6205

Q34: Which of the following statements about initial

Q43: A financial planner has suggested you invest

Q59: The 1-year Brazilian central bank rate is

Q102: 6.2 _ 6.3<br>A) <span class="ql-formula"

Q306: -3(-4)(3)<br>A)26<br>B)136<br>C)36<br>D)-36