Multiple Choice

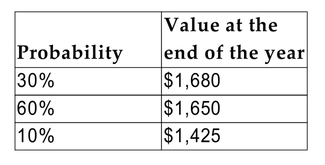

An investment will cost $1,500 today. You have estimated the following probability distribution for the

Value of the investment one year from now:  Calculate the expected rate of return and the standard deviation of the returns for the 1-year

Calculate the expected rate of return and the standard deviation of the returns for the 1-year

Holding period.

Definitions:

Related Questions

Q8: The correlation of two variables will be<br>A)between

Q13: Which of the following statements is true?<br>A)A

Q19: If a British firm issues a bond

Q20: An investment of $20,000 today has the

Q36: A major provider of investment bank ratings

Q41: What is the difference between the assumption

Q52: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8419/.jpg" alt=" A)

Q52: When a company that is already publicly-held

Q53: 77 - 4 ·15 + 240 ÷

Q65: When the acquiring entity in a leveraged