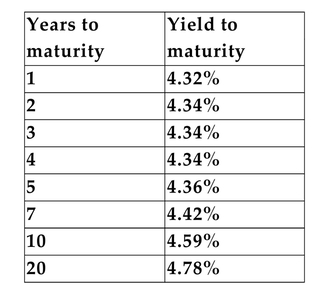

Assume that the following data on U.S. Treasury securities is current:

-Refer to the information above. What is the implied annualized interest rate on a 10-year bond that is issued 10 years from today.

Definitions:

Future Transaction Value

The predicted or estimated financial value of a transaction that will occur at a later date, often used in forecasting and budgeting.

Current Market Value

The present value at which an asset can be bought or sold in a current transaction between willing parties.

Realizable Future Value

The expected market value of an asset in the future, considering factors like inflation, interest rates, and market demand.

Marketable Debt

Debt securities that are readily available for purchase and sale in the public market.

Q9: If shares in successful IPOs are oversubscribed

Q12: What decision should be made regarding each

Q14: A certain company's cash flows are expected

Q22: Newbie Business Center has borrowed $12,000 from

Q25: An American investor invested in the Swiss

Q29: The following equally likely outcomes have been

Q33: Refer to the information above. What is

Q49: A certain project is expected to produce

Q58: A project that costs $12,000 today is

Q71: <span class="ql-formula" data-value="\left( \frac { 1 }