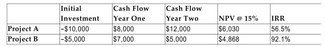

Two mutually exclusive projects have the following expected cash flows, net present values, and internal rates of return:  If the appropriate discount rate is 15%, which project should be undertaken and why?

If the appropriate discount rate is 15%, which project should be undertaken and why?

Definitions:

Cross-training

A training method where employees learn multiple roles within the organization, enhancing flexibility and understanding across different functions.

Document Delivery Company

A service provider focused on the rapid and secure transmission of documents between parties, often leveraging digital technologies.

Robotics Company

An enterprise engaged in the design, construction, operation, and application of robots and related technology.

Assembly Line

A manufacturing process in which parts are added to a product in a sequential manner to create a finished product more efficiently.

Q5: An argument for using the market value

Q16: If tax laws were to change such

Q21: A printed financial advertisement of an upcoming

Q24: A major result of the repeal of

Q31: Which of the following is a lesson

Q45: Based on a study of capital structure

Q52: Refer to the information above. A stock

Q59: When considering the historical performance of a

Q64: What are the problems involved in using

Q210: <span class="ql-formula" data-value="\frac { \mathrm { m