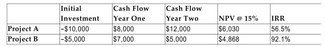

Two mutually exclusive projects have the following expected cash flows, net present values, and internal rates of return:  If the appropriate discount rate is 15%, which project should be undertaken and why?

If the appropriate discount rate is 15%, which project should be undertaken and why?

Definitions:

Island Arcs

Chains of volcanic islands that form along subduction zones where one oceanic plate subducts beneath another.

Ocean-ocean Convergent

A tectonic boundary where two oceanic plates collide, typically resulting in the subduction of one plate beneath the other and often forming volcanic island arcs.

Tectonic Setting

The environmental context related to the structure and movement of the Earth’s crust, including plate boundaries and associated geological activity.

Performance Pyramid

A model that outlines how different levels of organizational and individual performance measures align and contribute to the overall objectives.

Q10: In a risk-neutral world, the realized default

Q12: Which of the following assets are included

Q22: Which of the following income statement accounts

Q28: Refer to the information above. Assume that

Q29: Which of the following statements about the

Q38: Explain the mechanics of a credit default

Q40: All else equal, the price of a

Q60: Empirical evidence suggests that when a firm's

Q68: <span class="ql-formula" data-value="\frac { 3 m ^

Q82: <span class="ql-formula" data-value="\left( 4 \times 10 ^