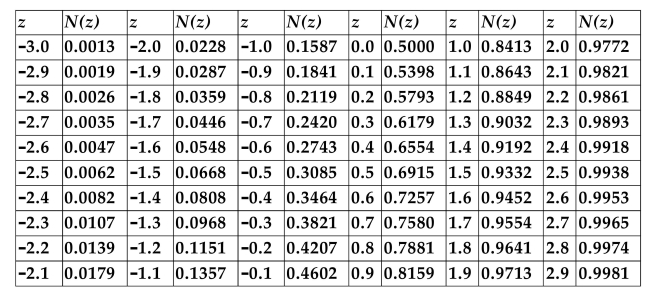

CUMULATIVE NORMAL DISTRIBUTION TABLE

-Refer to the information above. A stock is currently selling for $42. The stock pays no dividends. An American call option on the stock has a strike price of $45 and has 6 months to

Expiration. The standard deviation of the continuously compounded rate of return of the stock

Is 25%, and the annualized risk-free rate is 3%. Use the Black-Scholes formula to calculate the

Fair value of this option.

Definitions:

Premature Termination

Ending a process or activity earlier than planned or expected, often without achieving the intended goals.

Adjourning Stage

The final phase in group development where the group completes its task, dissolves structures, and members separate, moving on to other things.

Group Development

The stages through which a group goes as it matures, typically starting from formation to performing tasks effectively together.

Empirical Studies

Research based on the collection and analysis of data, typically through observation and experimentation.

Q6: You invested $10,000 in a zero-coupon bond.

Q7: A risk-free investment of $10,000 will return

Q7: You own 5,000 shares of a stock

Q23: A $20,000, level-coupon Eurobond pays interest annually

Q29: You have just won a lottery that

Q29: If a firm issues an additional $1

Q34: Your newborn daughter has received a total

Q41: What are some tax issues that might

Q57: A firm has 1,000 shareholders. Both you

Q61: You have an investment opportunity that will