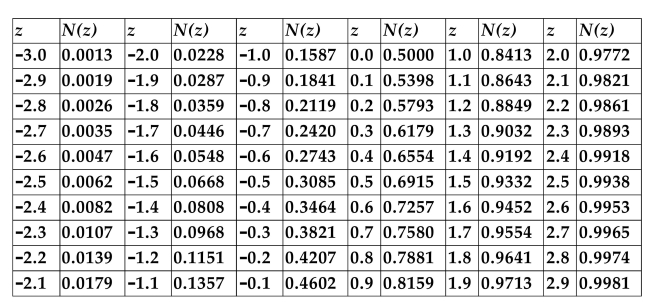

CUMULATIVE NORMAL DISTRIBUTION TABLE

-Refer to the information above. A stock is currently selling for $60. The stock pays no dividends. A call option on the stock has a strike price of $55 and has 3 months to expiration.

The implied volatility is 30%, and the annualized risk-free rate is 3%. What is the option's

Hedge ratio, rounded to the nearest hundredth?

Definitions:

Agent

An individual or entity authorized to act on behalf of another, called the principal, in transactions or other matters.

Reacquisition

Reacquisition refers to the act of regaining possession or control of something that was previously sold, lost, or given away.

Unauthorized Signature

A signature made without the expressed permission of the person whose name is signed, often considered illegal or invalid.

Cancellation

The act of calling off or terminating an agreement, reservation, or contractual obligation before its completion.

Q3: Refer to the information above. What is

Q4: Which of the following statements about stock

Q21: Refer to the information above. Calculate Carmela's

Q22: Which of the following income statement accounts

Q50: Which of the following is a reason

Q51: A firm paid a dividend of $1.68

Q51: Currency hedging can increase firm value<br>A)by increasing

Q51: Which of the following is not a

Q52: A project has the following possible outcomes:

Q52: A "real return" is<br>A)a return that has