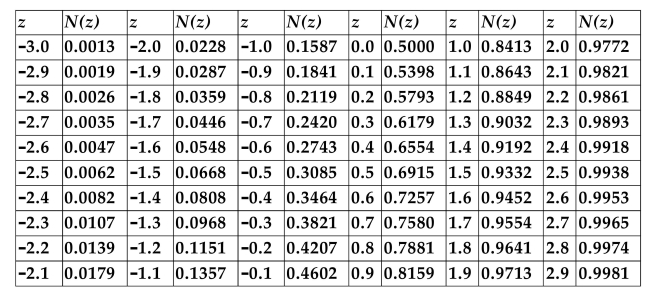

CUMULATIVE NORMAL DISTRIBUTION TABLE

-Refer to the information above. A stock is currently selling for $42. The stock pays no dividends. An American call option on the stock has a strike price of $45 and has 6 months to

Expiration. The standard deviation of the continuously compounded rate of return of the stock

Is 25%, and the annualized risk-free rate is 3%. Use the Black-Scholes formula to calculate the

Fair value of this option.

Definitions:

Seasonal Indexes

Quantitative measures that adjust data for recurring seasonal effects to better understand underlying trends.

Motor Oil Sales

The volume or amount of motor oil sold within a specific period.

Centered Moving Averages

A method used in time series analysis to smooth out short-term fluctuations and highlight longer-term trends or cycles by averaging data points in the middle of a set time window.

Quarterly Sales

The total sales revenue generated by a company or entity within a three-month period.

Q6: Refer to the information above. What default

Q7: Security A is expected to return 12%

Q13: An investor invests $4,000 to buy 200

Q32: An American investor invested in British Airways

Q33: Refer to the information above. Calculate the

Q39: Which of the following theories provides a

Q39: Under what two conditions might an American

Q40: Assume that a stock is currently selling

Q45: If purchasing power parity holds, then which

Q59: The 1-year Brazilian central bank rate is