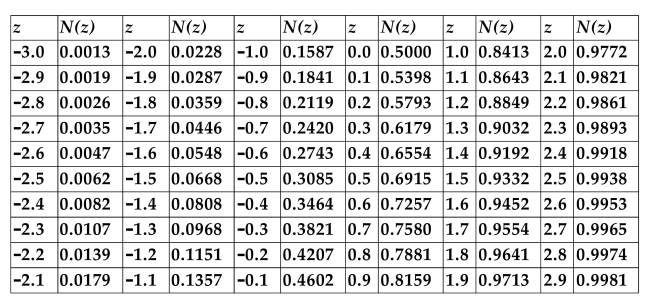

CUMULATIVE NORMAL DISTRIBUTION TABLE

-Refer to the information above. Calculate the value of a call option on a stock that is

currently selling for $88 if the strike price is $90, the option expires in 3 months, the

implied volatility of the underlying stock returns is 22%, and the annualized risk-free

rate is 4%.

Definitions:

Purchasing Power

The value of a currency expressed in terms of the amount of goods or services that one unit of money can buy.

Gross Domestic Product

The total value of all goods and services produced within a country's borders in a specific time period.

Currency Fluctuation

The variation in the exchange rate of one currency relative to another over time, influenced by economic factors, market demand, and geopolitical events.

Trade Restrictions

Government-imposed regulations that limit the free import and export of goods between countries, often to protect domestic industries.

Q2: A firm has 2 million shares outstanding,

Q22: The highest job title that Goldman Sachs

Q23: Empirical evidence suggests that<br>A)managers tend to borrow

Q28: You purchased a home worth $400,000, with

Q28: How do special dividends differ from regular

Q37: Assume a 1-year Treasury security offers a

Q40: Refer to the information above. What is

Q55: Which of the following best defines the

Q58: According to the empirical data on U.S.

Q60: How is a revolver different from term