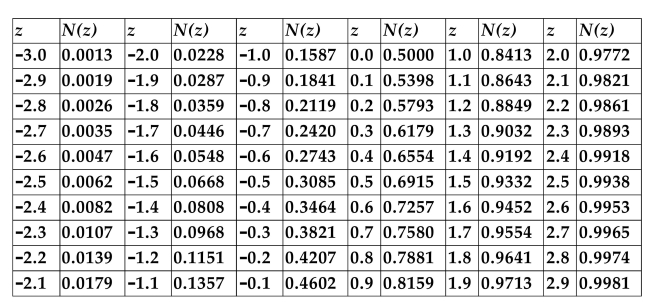

CUMULATIVE NORMAL DISTRIBUTION TABLE

-Refer to the information above. A stock is currently selling for $60. The stock pays no dividends. A call option on the stock has a strike price of $55 and has 3 months to expiration.

The implied volatility is 30%, and the annualized risk-free rate is 3%. What is the option's

Hedge ratio, rounded to the nearest hundredth?

Definitions:

Population Ratio

A statistical term that represents the proportion of individuals in one category to the total number of individuals in all categories within a given population.

Universal Changes

General transformations or modifications that affect everyone or everything, regardless of specifics.

Sexual Satisfaction

Sexual satisfaction is the degree of contentment and fulfillment one experiences in one's sexual life, which can influence overall well-being and relationship quality.

Self-Fulfilling Prophecies

Self-fulfilling prophecies are predictions that, once made, influence behaviors and actions in a way that causes the prediction to come true.

Q12: Which of the following is not a

Q21: Refer to the information above. What was

Q24: Refer to the information above. Calculate the

Q33: Which of the following is not a

Q35: Refer to the information above. Based on

Q39: Refer to the information above. The expected

Q44: Project A has a profitability index of

Q47: Assume you have a 2-factor APT model.

Q61: You have an investment opportunity that will

Q63: Refer to the information above. What is